Natural gas use being expanded in the domestic market 012/23/1920 • bit.ly/3j5AuaO

The creation of gas supply and infrastructure for the expansion of the gas grid in Russian regions for housing, utilities, and industries is a strategic activity for Gazprom. The 2016-2020 expansion programme that is…

Eni has signed a concession agreement for the acquisition of a 70% stake in the oil and gas Exploration Offshore Block 3 located in the Abu Dhabi Emirate. The company is leading a consortium…

Eni has signed a concession agreement for the acquisition of a 70% stake in the oil and gas Exploration Offshore Block 3 located in the Abu Dhabi Emirate. The company is leading a consortium…

Australia is looking towards nurturing a high-tech manufacturing industry producing electrolysers, hydrogen storage and transport solutions, solar PV modules, and grid-disconnected microgrids…

Australia is looking towards nurturing a high-tech manufacturing industry producing electrolysers, hydrogen storage and transport solutions, solar PV modules, and grid-disconnected microgrids…

Woodmac expects that in a two-degree world green hydrogen will become a long-run game changer, emerging as a key competitor to natural gas consumption towards the end of 2040…

Woodmac expects that in a two-degree world green hydrogen will become a long-run game changer, emerging as a key competitor to natural gas consumption towards the end of 2040…

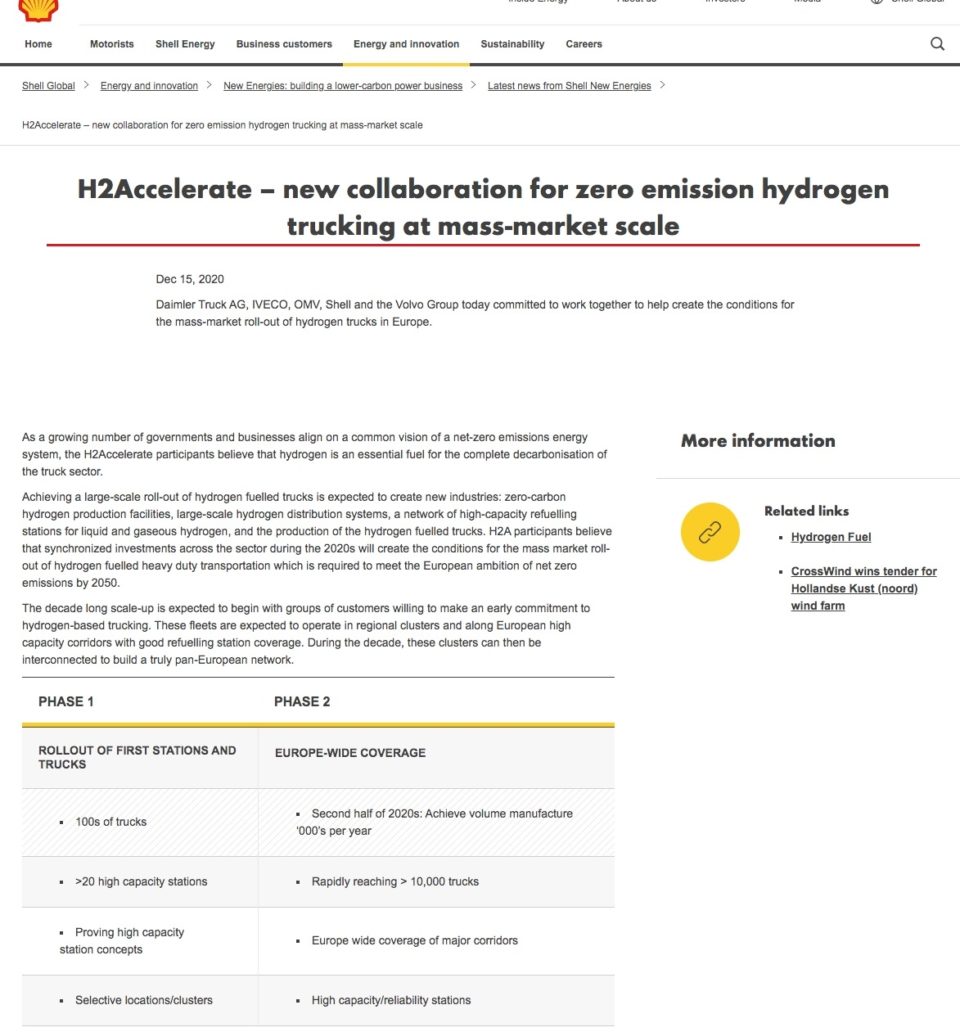

Daimler Truck AG, IVECO, OMV, Shell and the Volvo Group are participating in the collaboration agreement “H2 Accelerate” with the aim of creating the conditions for a mass-market…

Daimler Truck AG, IVECO, OMV, Shell and the Volvo Group are participating in the collaboration agreement “H2 Accelerate” with the aim of creating the conditions for a mass-market…

Unless petroleum exploration speeds up significantly and capital expenditure of at least $3 trillion is put to the task, the world will not have sufficient oil supplies to meet its needs through 2050…

Unless petroleum exploration speeds up significantly and capital expenditure of at least $3 trillion is put to the task, the world will not have sufficient oil supplies to meet its needs through 2050…

Part of the plans for a “Green Industrial Revolution” in the UK is to build a nuclear fusion power station that will be wired to the national power grid. This is the STEP project: the Spherical Tokamak for Energy Production…

Part of the plans for a “Green Industrial Revolution” in the UK is to build a nuclear fusion power station that will be wired to the national power grid. This is the STEP project: the Spherical Tokamak for Energy Production…

BP has become the first oil major to set a net-zero carbon emissions target by 2050. It is unclear, however, how fast the world will move away from oil, natural gas, and coal and embrace renewable power…

BP has become the first oil major to set a net-zero carbon emissions target by 2050. It is unclear, however, how fast the world will move away from oil, natural gas, and coal and embrace renewable power…

Rystad Energy sees its peak demand forecast coming in 2028, two years earlier than expected, at 102 million barrels per day rather than 106 million bpd. Oil field service purchases are expected to stay flat in 2021…

Rystad Energy sees its peak demand forecast coming in 2028, two years earlier than expected, at 102 million barrels per day rather than 106 million bpd. Oil field service purchases are expected to stay flat in 2021…

In order to keep up with Tesla’s growth in China South Korea’s LG Chem Ltd plans to more than double production capacity of battery cells that it makes in China for Tesla electric vehicles…

In order to keep up with Tesla’s growth in China South Korea’s LG Chem Ltd plans to more than double production capacity of battery cells that it makes in China for Tesla electric vehicles…

Intergen has gained planning permission for a 320MV/640MWh lithium-ion battery site at DP World London Gateway. The $267 million project could be expanded as far as 1.3GWh…

Intergen has gained planning permission for a 320MV/640MWh lithium-ion battery site at DP World London Gateway. The $267 million project could be expanded as far as 1.3GWh…

SSE Renewables and Equinor have announced the completion of a deal that will finance the project for a major offshore wind farm: the Dogger Bank wind farm in the UK…

SSE Renewables and Equinor have announced the completion of a deal that will finance the project for a major offshore wind farm: the Dogger Bank wind farm in the UK…