The Debt Problem… Again 09/10/19 • bit.ly/2kCWlfX • lweb.es/a?a=7994

This article presents an introduction to global indebtedness and to some of the proposed solutions to the problem. Here, a long-term global perspective is needed to allow the design of adequate policies.

This article presents an introduction to global indebtedness and to some of the proposed solutions to the problem. Here, a long-term global perspective is needed to allow the design of adequate policies.

Up to now foreign ownership has been capped at 49%, but foreigners will in principle be able to acquire a majority stake in public companies in sectors not considered critical to national security…

Up to now foreign ownership has been capped at 49%, but foreigners will in principle be able to acquire a majority stake in public companies in sectors not considered critical to national security…

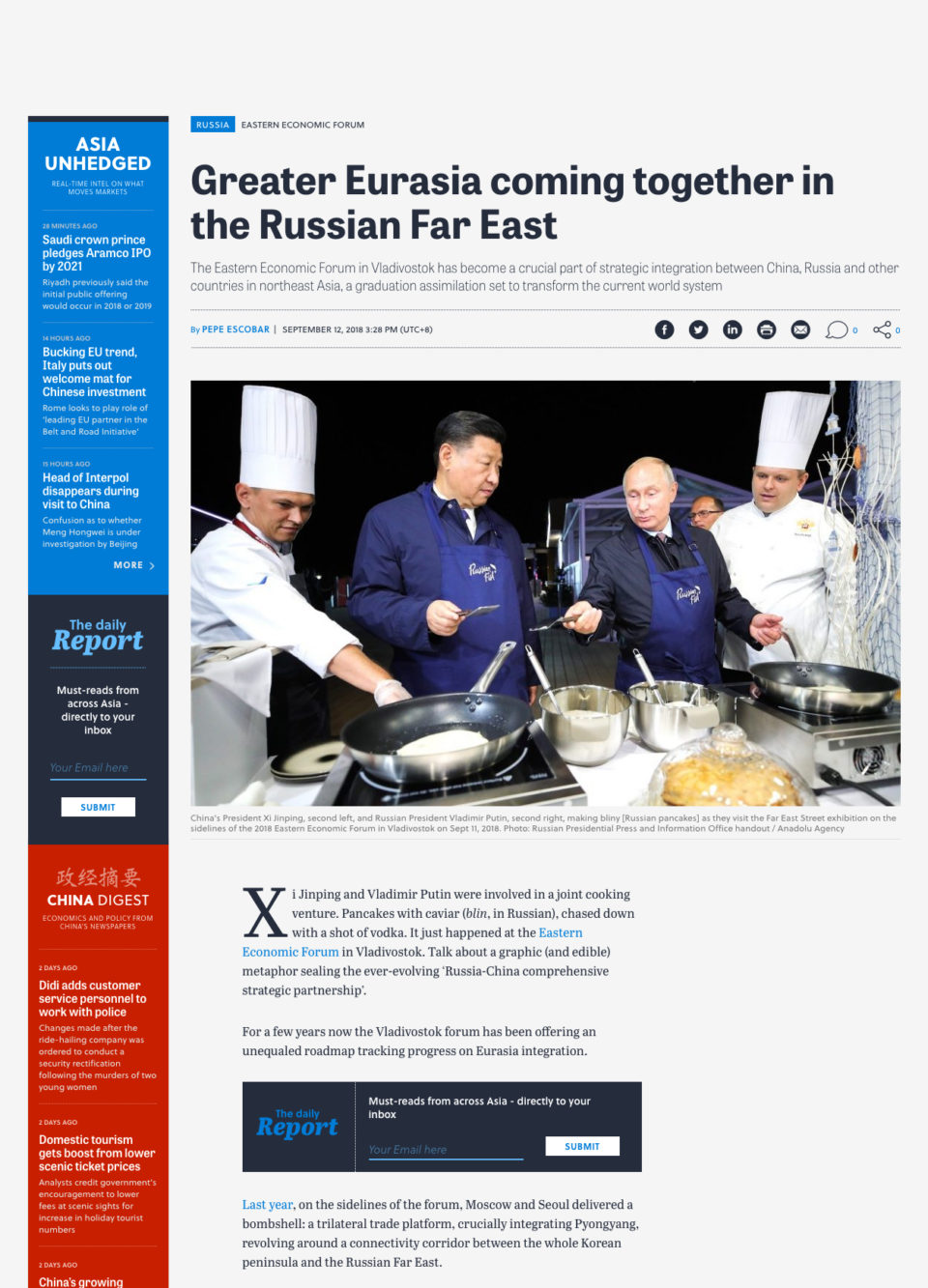

This is the first time ever that a Chinese leader has joined the Vladivostok discussions. China is progressively interconnecting with the Russian Far East…

This is the first time ever that a Chinese leader has joined the Vladivostok discussions. China is progressively interconnecting with the Russian Far East…

Kenya’s ambition to be a global oil producer has been boosted following the flagging off of the first barrels destined for Mombasa from Turkana fields.

Kenya’s ambition to be a global oil producer has been boosted following the flagging off of the first barrels destined for Mombasa from Turkana fields.

Nigeria’s economy is exiting a painful recession, but policy implementation needs to move quickly and comprehensively to facilitate economic recovery and help the country…

Nigeria’s economy is exiting a painful recession, but policy implementation needs to move quickly and comprehensively to facilitate economic recovery and help the country… Hydraulic fracturing – or fracking – has been at the center of controversies about contaminating water sources and causing earthquakes.

Hydraulic fracturing – or fracking – has been at the center of controversies about contaminating water sources and causing earthquakes.  According to an Arab Monetary Fund analysis, most of the Arab oil-exporting countries have had to readjust owing to unfavorable global economic developments.

According to an Arab Monetary Fund analysis, most of the Arab oil-exporting countries have had to readjust owing to unfavorable global economic developments.  Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror.

Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror. Global clean energy investment was $53.6 billion in the first quarter of 2017, down 17 per cent from the same period in 2016.

Global clean energy investment was $53.6 billion in the first quarter of 2017, down 17 per cent from the same period in 2016.  The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War.

The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War. Saudi Arabian King Salman bin Abdul-Aziz al-Saud and Japan PM Shinzo Abe met in Tokyo and agreed to launch a feasibility study on setting up special deregulated economic zones to attract Japanese firms to the Middle Eastern country.

Saudi Arabian King Salman bin Abdul-Aziz al-Saud and Japan PM Shinzo Abe met in Tokyo and agreed to launch a feasibility study on setting up special deregulated economic zones to attract Japanese firms to the Middle Eastern country.  As China’s foreign exchange reserves threaten to tumble below the critical $3 trillion mark, there are fears that it will set off a vicious cycle of more outflows and currency depreciation.

As China’s foreign exchange reserves threaten to tumble below the critical $3 trillion mark, there are fears that it will set off a vicious cycle of more outflows and currency depreciation.