Eni to grow Abu Dhabi’s hydrocarbon resources 12/22/20 • bit.ly/36sqGlZ

Eni has signed a concession agreement for the acquisition of a 70% stake in the oil and gas Exploration Offshore Block 3 located in the Abu Dhabi Emirate. The company is leading a consortium…

Eni has signed a concession agreement for the acquisition of a 70% stake in the oil and gas Exploration Offshore Block 3 located in the Abu Dhabi Emirate. The company is leading a consortium…

Unless petroleum exploration speeds up significantly and capital expenditure of at least $3 trillion is put to the task, the world will not have sufficient oil supplies to meet its needs through 2050…

Unless petroleum exploration speeds up significantly and capital expenditure of at least $3 trillion is put to the task, the world will not have sufficient oil supplies to meet its needs through 2050…

BP has become the first oil major to set a net-zero carbon emissions target by 2050. It is unclear, however, how fast the world will move away from oil, natural gas, and coal and embrace renewable power…

BP has become the first oil major to set a net-zero carbon emissions target by 2050. It is unclear, however, how fast the world will move away from oil, natural gas, and coal and embrace renewable power…

Rystad Energy sees its peak demand forecast coming in 2028, two years earlier than expected, at 102 million barrels per day rather than 106 million bpd. Oil field service purchases are expected to stay flat in 2021…

Rystad Energy sees its peak demand forecast coming in 2028, two years earlier than expected, at 102 million barrels per day rather than 106 million bpd. Oil field service purchases are expected to stay flat in 2021…

The US shale industry has gradually started to adapt to the new pricing environment with a series of mergers and acquisitions in the industry that are bringing with them a new optimism…

The US shale industry has gradually started to adapt to the new pricing environment with a series of mergers and acquisitions in the industry that are bringing with them a new optimism…

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

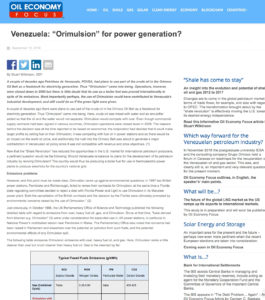

A couple of decades ago Petróleos de Venezuela, PDVSA, had plans to use part of the crude oil in the Orinoco Oil Belt as a feedstock for electricity generation. Thus “Orimulsion” came into being…

A couple of decades ago Petróleos de Venezuela, PDVSA, had plans to use part of the crude oil in the Orinoco Oil Belt as a feedstock for electricity generation. Thus “Orimulsion” came into being…

According to Rystad Energy, “Economic recession risk and further escalation of the U.S.-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” said the head of oil market analysis at the company…

According to Rystad Energy, “Economic recession risk and further escalation of the U.S.-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” said the head of oil market analysis at the company…

As several pipelines connecting West Texas and the Gulf Cast near completion, various companies have proposed at least eight offshore oil-export terminals…

As several pipelines connecting West Texas and the Gulf Cast near completion, various companies have proposed at least eight offshore oil-export terminals…

The International Maritime Organization’s regulations that prohibit ships from using dirty fuel from the 1st January are set to bolster diesel demand, while cutting fuel oil use.

The International Maritime Organization’s regulations that prohibit ships from using dirty fuel from the 1st January are set to bolster diesel demand, while cutting fuel oil use.

Researchers have used liquid metals to turn carbon dioxide (CO2) back into solid coal with technology they say has the potential to revolutionize carbon capture and storage and provide a new way for removing greenhouse gases from the atmosphere…

Researchers have used liquid metals to turn carbon dioxide (CO2) back into solid coal with technology they say has the potential to revolutionize carbon capture and storage and provide a new way for removing greenhouse gases from the atmosphere…