Natural gas use being expanded in the domestic market 012/23/1920 • bit.ly/3j5AuaO

The creation of gas supply and infrastructure for the expansion of the gas grid in Russian regions for housing, utilities, and industries is a strategic activity for Gazprom. The 2016-2020 expansion programme that is…

Russia’s mainstream oil producers Rosneft, Gazprom and Lukoil increased pressure on Russia’s president Vladimir Putin to slow down preparations for the expected marriage with OPEC…

Russia’s mainstream oil producers Rosneft, Gazprom and Lukoil increased pressure on Russia’s president Vladimir Putin to slow down preparations for the expected marriage with OPEC…

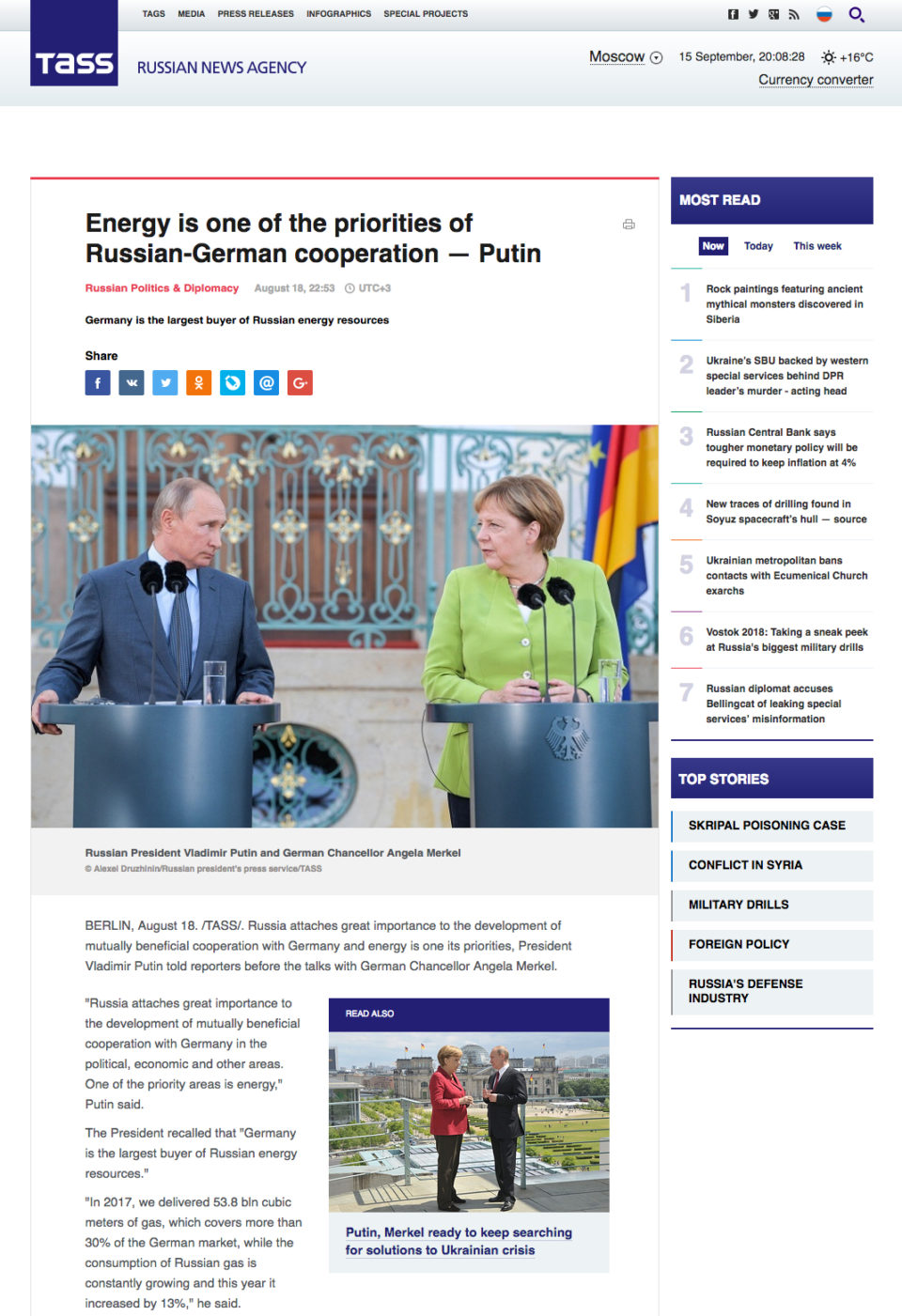

“Russia attaches great importance to the development of mutually beneficial cooperation with Germany in the political, economic and other areas.

“Russia attaches great importance to the development of mutually beneficial cooperation with Germany in the political, economic and other areas.  Moscow is manoeuvring itself to take advantage of the rapprochement on the Korean peninsula by reviving a decades-old energy megaproject that would connect Russian gas…

Moscow is manoeuvring itself to take advantage of the rapprochement on the Korean peninsula by reviving a decades-old energy megaproject that would connect Russian gas… Thirty oil and gas discoveries were made in the third quarter of 2017. Russia led the field with eight discoveries, followed by Norway and Australia with five and three discoveries respectively.

Thirty oil and gas discoveries were made in the third quarter of 2017. Russia led the field with eight discoveries, followed by Norway and Australia with five and three discoveries respectively. The Nigerian Senate has begun talks with Russian oil companies to develop Nigeria’s oil and gas sector in partnership.

The Nigerian Senate has begun talks with Russian oil companies to develop Nigeria’s oil and gas sector in partnership.  Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror.

Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror. The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War.

The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War.