South China Sea: Exploration and development 10/13/18 • bit.ly/2NNtD4I

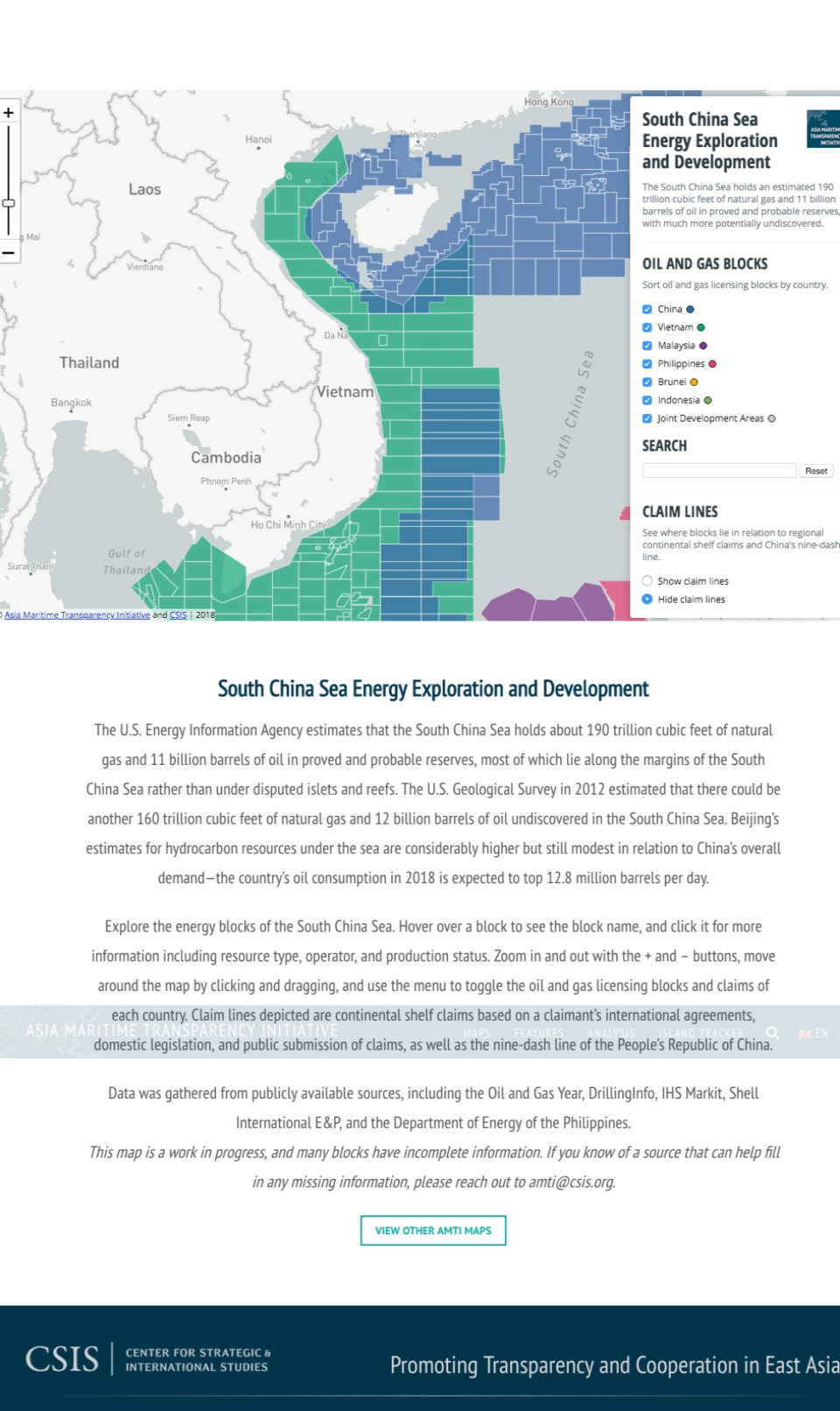

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

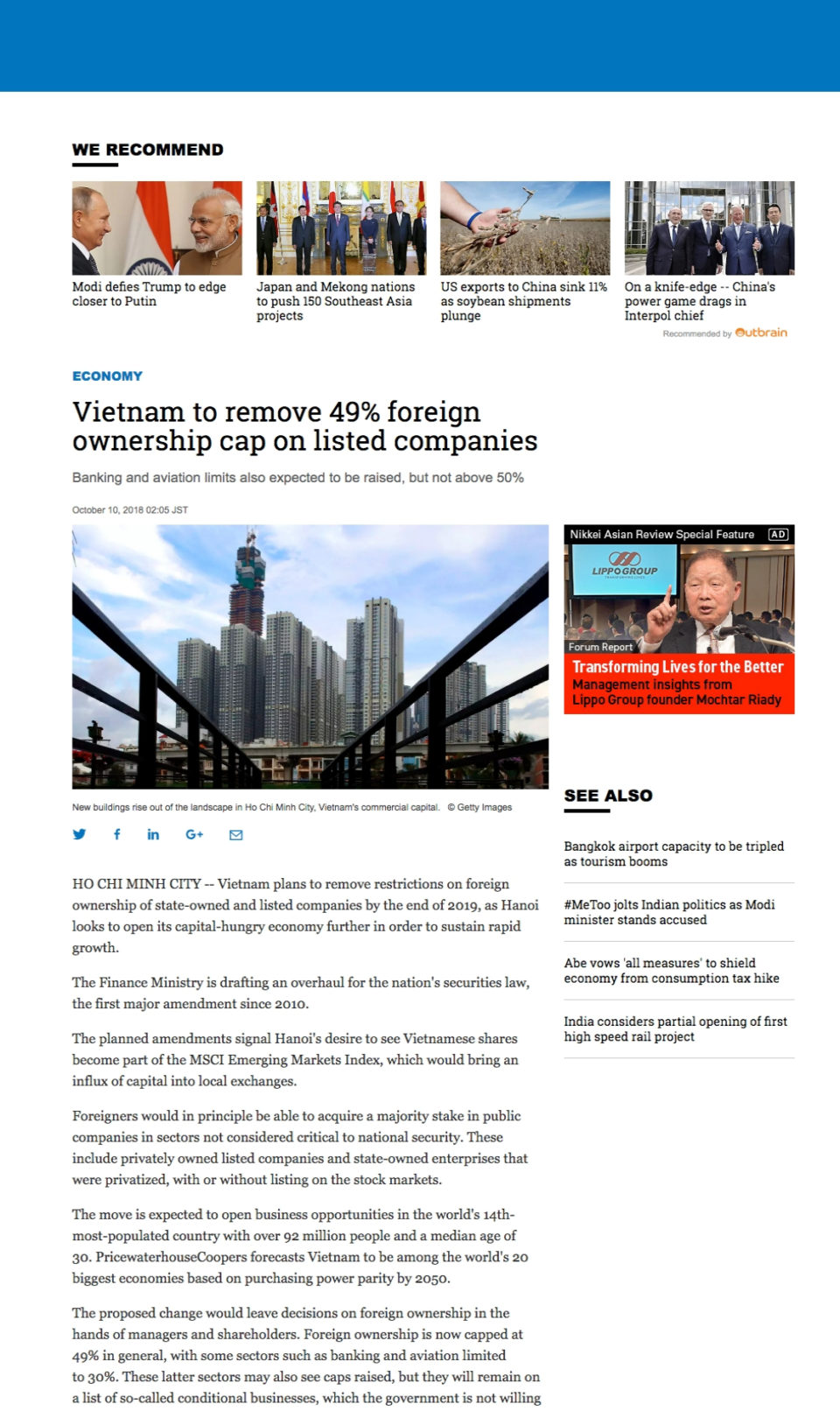

Up to now foreign ownership has been capped at 49%, but foreigners will in principle be able to acquire a majority stake in public companies in sectors not considered critical to national security…

Up to now foreign ownership has been capped at 49%, but foreigners will in principle be able to acquire a majority stake in public companies in sectors not considered critical to national security…

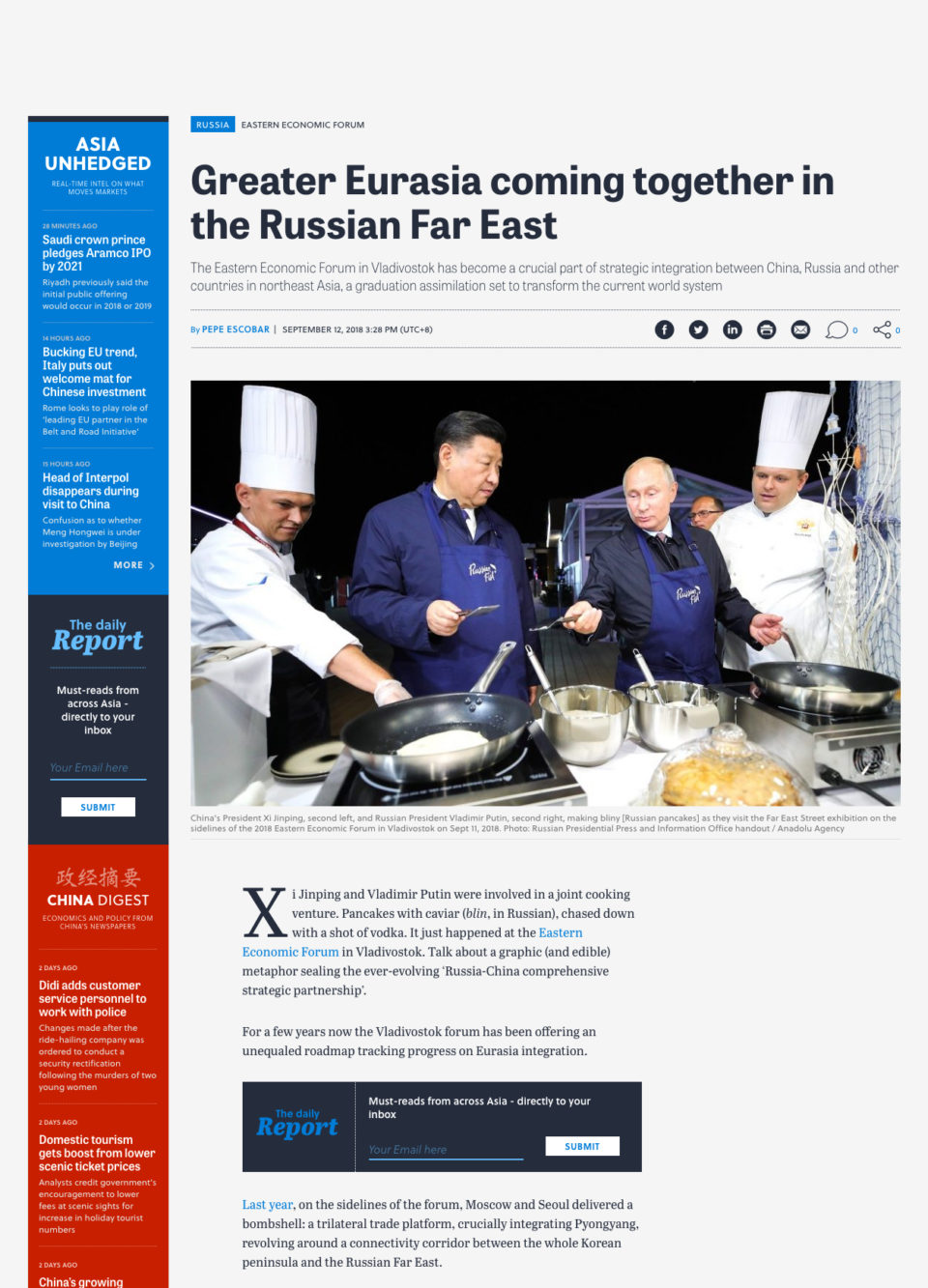

This is the first time ever that a Chinese leader has joined the Vladivostok discussions. China is progressively interconnecting with the Russian Far East…

This is the first time ever that a Chinese leader has joined the Vladivostok discussions. China is progressively interconnecting with the Russian Far East… Moscow is manoeuvring itself to take advantage of the rapprochement on the Korean peninsula by reviving a decades-old energy megaproject that would connect Russian gas…

Moscow is manoeuvring itself to take advantage of the rapprochement on the Korean peninsula by reviving a decades-old energy megaproject that would connect Russian gas… “U.S. crude is becoming more and more popular,” said the world’s biggest refiner Sinopec. There are three reasons for Asian oil buyers’ interest in U.S. crude: first, it fits the configuration of Asian refineries, which like to process high quality so-called light sweet crude that yields more petroleum products such as gasoline and diesel. Second, it’s cheap, with WTI trading at times at a steep discount to other oil benchmarks. Third, the cargoes are bought on a spot basis, giving refiners flexibility to complement their more traditional Middle Eastern supplies that are sourced via long-term contracts.

“U.S. crude is becoming more and more popular,” said the world’s biggest refiner Sinopec. There are three reasons for Asian oil buyers’ interest in U.S. crude: first, it fits the configuration of Asian refineries, which like to process high quality so-called light sweet crude that yields more petroleum products such as gasoline and diesel. Second, it’s cheap, with WTI trading at times at a steep discount to other oil benchmarks. Third, the cargoes are bought on a spot basis, giving refiners flexibility to complement their more traditional Middle Eastern supplies that are sourced via long-term contracts.