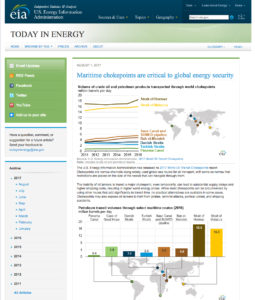

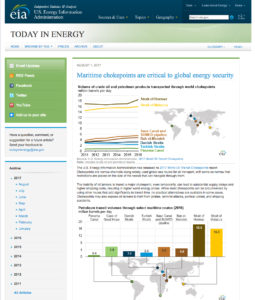

The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints.

The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints.

Saudi Aramco has signed a $10-billion agreement to form a joint venture with Norinco, and Panjin Sincen to develop a fully integrated, grassroots refining and petrochemical complex in Panjin…

Saudi Aramco has signed a $10-billion agreement to form a joint venture with Norinco, and Panjin Sincen to develop a fully integrated, grassroots refining and petrochemical complex in Panjin…

European governments must not be detracted from developing a unified strategy to prevent Russian energy interventions, speakers agreed at a 24th May Atlantic Council forum.

European governments must not be detracted from developing a unified strategy to prevent Russian energy interventions, speakers agreed at a 24th May Atlantic Council forum.

Centrica is undertaking a trial to explore how blockchain technology could revolutionize the way consumers buy and sell energy.

Centrica is undertaking a trial to explore how blockchain technology could revolutionize the way consumers buy and sell energy.

Flashpoints in the Middle East and North Africa have already been the main focus of attention this year and have the potential to cause fresh price volatility, particularly as global spare capacity thins and economic recovery stokes demand growth.

Flashpoints in the Middle East and North Africa have already been the main focus of attention this year and have the potential to cause fresh price volatility, particularly as global spare capacity thins and economic recovery stokes demand growth.

U.S. Interior Secretary Ryan Zinke said nearly all of the U.S. outer continental shelf is being considered for drilling, including areas off the coasts of Maine, California, Florida and Alaska.

U.S. Interior Secretary Ryan Zinke said nearly all of the U.S. outer continental shelf is being considered for drilling, including areas off the coasts of Maine, California, Florida and Alaska.

The cost of generating power from onshore wind has fallen by around a quarter since 2010; solar photovoltaic (PV) electricity costs have fallen by 73 per cent in that time and are expected to halve by 2020.

The cost of generating power from onshore wind has fallen by around a quarter since 2010; solar photovoltaic (PV) electricity costs have fallen by 73 per cent in that time and are expected to halve by 2020. A Qatari delegation to China, led by Saad Sherida Al-Kaabi, Qatar Petroleum president & CEO and the chairman of the country’s LNG producer, Qatargas, will hold meetings with Chinese energy majors including China National Offshore Oil Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Beijing Gas, among others.

A Qatari delegation to China, led by Saad Sherida Al-Kaabi, Qatar Petroleum president & CEO and the chairman of the country’s LNG producer, Qatargas, will hold meetings with Chinese energy majors including China National Offshore Oil Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Beijing Gas, among others.  A consortium consisting of BP, Shell, Statoil, trading houses Gunvor, Koch Supply & Trading, Mercuria, and banks ABN Amro, ING and Societe Generale will develop a blockchain-based digital platform for energy commodities trading.

A consortium consisting of BP, Shell, Statoil, trading houses Gunvor, Koch Supply & Trading, Mercuria, and banks ABN Amro, ING and Societe Generale will develop a blockchain-based digital platform for energy commodities trading.  The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints.

The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints. According to the 2017 BP Statistical Review, rapid growth and improving prosperity mean growth in energy demand is increasingly coming from developing economies, particularly within Asia, rather than from traditional markets in the OECD. However, the drive to improve energy efficiency is causing global energy consumption overall to decelerate. Global carbon emissions are improving, and this can be traced back to the changes in the pace and pattern of economic growth and energy consumption within China. Globally, wind and solar power grew strongly, accounting for almost a third of the increase in primary energy last year.

According to the 2017 BP Statistical Review, rapid growth and improving prosperity mean growth in energy demand is increasingly coming from developing economies, particularly within Asia, rather than from traditional markets in the OECD. However, the drive to improve energy efficiency is causing global energy consumption overall to decelerate. Global carbon emissions are improving, and this can be traced back to the changes in the pace and pattern of economic growth and energy consumption within China. Globally, wind and solar power grew strongly, accounting for almost a third of the increase in primary energy last year. Inventory draws expected in the second and third quarters of 2017 suggest the possibility of increases in oil prices over the coming months. However, because U.S. tight oil production is relatively responsive to price changes, higher oil prices in mid-2017 have the potential to raise U.S. supply in 2018. The largest global inventory increase may occur in the second quarter of 2018, when Brazilian and OPEC production are expected to increase by 570,000 b/d and 220,000 b/d, respectively. Supply growth in 2018 could contribute to downward pressure in oil prices as early as late 2017.

Inventory draws expected in the second and third quarters of 2017 suggest the possibility of increases in oil prices over the coming months. However, because U.S. tight oil production is relatively responsive to price changes, higher oil prices in mid-2017 have the potential to raise U.S. supply in 2018. The largest global inventory increase may occur in the second quarter of 2018, when Brazilian and OPEC production are expected to increase by 570,000 b/d and 220,000 b/d, respectively. Supply growth in 2018 could contribute to downward pressure in oil prices as early as late 2017.  The German company E.ON is investing in the development of airborne wind energy, which offers “game-changing technologies for renewable energy production”.

The German company E.ON is investing in the development of airborne wind energy, which offers “game-changing technologies for renewable energy production”.  Elon Musk has promised to install and get working a Tesla Inc. battery storage system designed to prevent blackouts in South Australia, the Australian mainland state most reliant on renewable energy.

Elon Musk has promised to install and get working a Tesla Inc. battery storage system designed to prevent blackouts in South Australia, the Australian mainland state most reliant on renewable energy.