Natural gas use being expanded in the domestic market 012/23/1920 • bit.ly/3j5AuaO

The creation of gas supply and infrastructure for the expansion of the gas grid in Russian regions for housing, utilities, and industries is a strategic activity for Gazprom. The 2016-2020 expansion programme that is…

Woodmac expects that in a two-degree world green hydrogen will become a long-run game changer, emerging as a key competitor to natural gas consumption towards the end of 2040…

Woodmac expects that in a two-degree world green hydrogen will become a long-run game changer, emerging as a key competitor to natural gas consumption towards the end of 2040…

Discoveries of shale gas in Nottinghamshire are equivalent to a trillion dollars-worth of gas, significantly higher than at one of the biggest fracking locations in the US…

Discoveries of shale gas in Nottinghamshire are equivalent to a trillion dollars-worth of gas, significantly higher than at one of the biggest fracking locations in the US… YPF’s 2018 hydrocarbon production will likely fall by 3% to 4% on the year as low natural gas demand forces it to close wells and shift its focus to Vaca Muerta shale oil.

YPF’s 2018 hydrocarbon production will likely fall by 3% to 4% on the year as low natural gas demand forces it to close wells and shift its focus to Vaca Muerta shale oil.

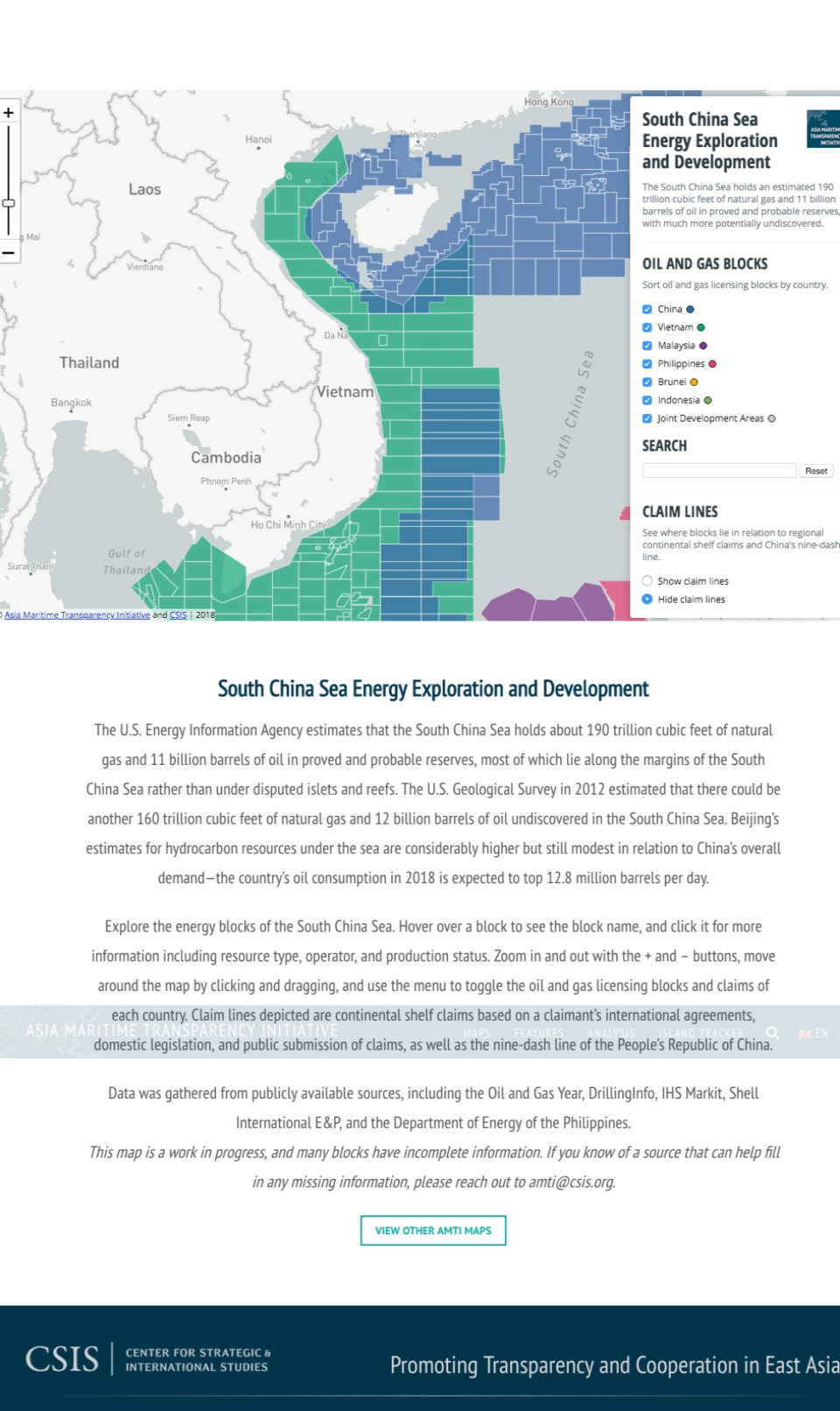

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

Polish oil refiner PKN Orlen expects to receive a first ever shipment of Nigerian crude oil as Poland seeks to reduce its reliance on Russian supplies.

Polish oil refiner PKN Orlen expects to receive a first ever shipment of Nigerian crude oil as Poland seeks to reduce its reliance on Russian supplies.

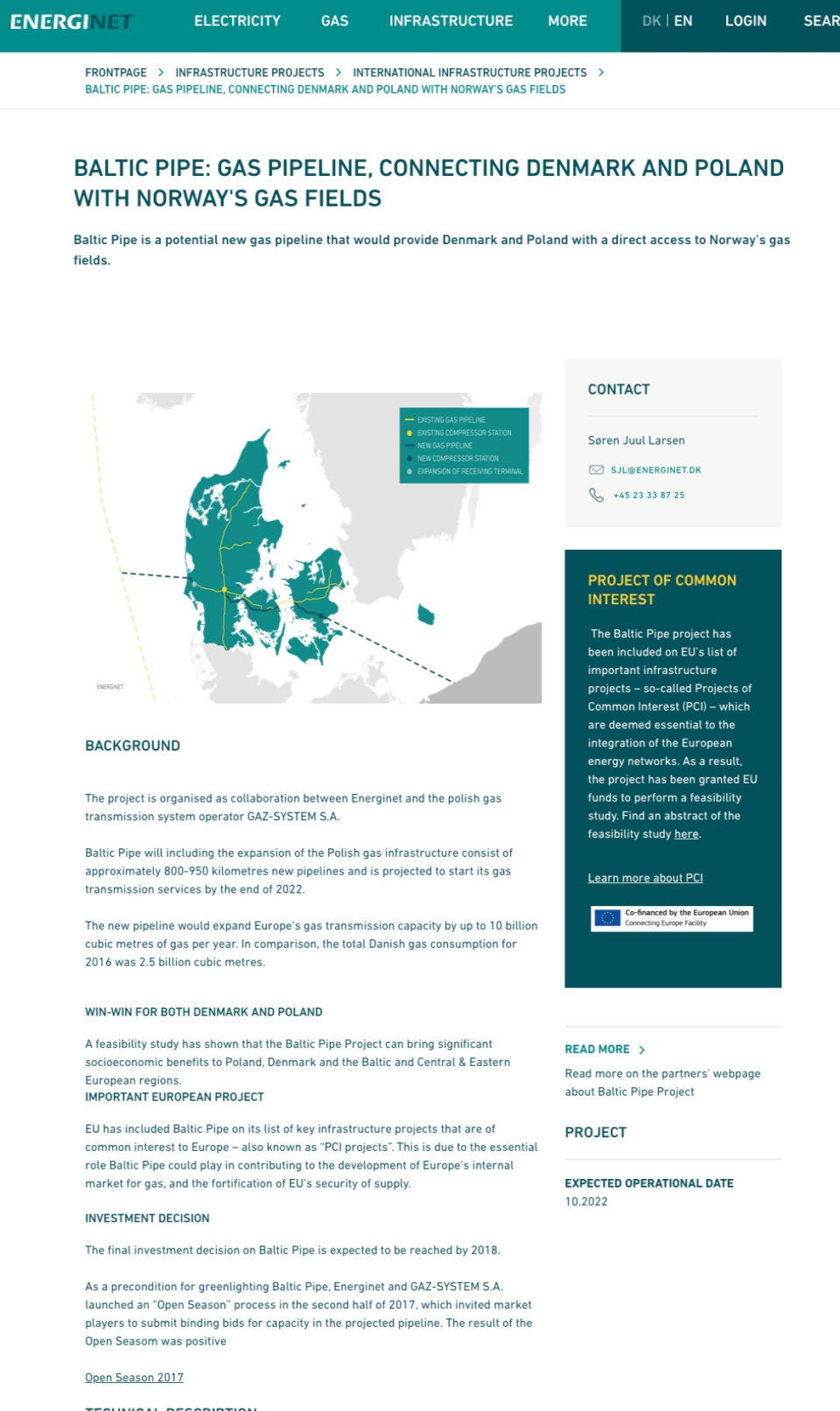

The Baltic Pipe gas pipeline will provide Denmark and Poland with direct access to Norway’s gas fields.

The Baltic Pipe gas pipeline will provide Denmark and Poland with direct access to Norway’s gas fields.

Argentina has opened bidding for 38 offshore blocks. The main driver of interest is that Argentina’s vast offshore region is “practically the last frontier” for offshore exploration.

Argentina has opened bidding for 38 offshore blocks. The main driver of interest is that Argentina’s vast offshore region is “practically the last frontier” for offshore exploration.

An analysis by Rystad Energy shows that a recent surge in offshore oil and gas Final Investment Decisions has set the stage for a significant increase in offshore investments next year.

An analysis by Rystad Energy shows that a recent surge in offshore oil and gas Final Investment Decisions has set the stage for a significant increase in offshore investments next year.

“We are not going to stop until we export US$ 30 billion in gas and oil from Vaca Muerta,” said Argentina president Mauricio Macri.

“We are not going to stop until we export US$ 30 billion in gas and oil from Vaca Muerta,” said Argentina president Mauricio Macri.

A total of 64 planned and announced crude and natural gas projects are expected to commence operations in sub-Saharan Africa between 2018 and 2025.

A total of 64 planned and announced crude and natural gas projects are expected to commence operations in sub-Saharan Africa between 2018 and 2025.