LG Chem to double China capacity for Tesla batteries 12/02/20 • bit.ly/39kXW0p

In order to keep up with Tesla’s growth in China South Korea’s LG Chem Ltd plans to more than double production capacity of battery cells that it makes in China for Tesla electric vehicles…

In order to keep up with Tesla’s growth in China South Korea’s LG Chem Ltd plans to more than double production capacity of battery cells that it makes in China for Tesla electric vehicles…

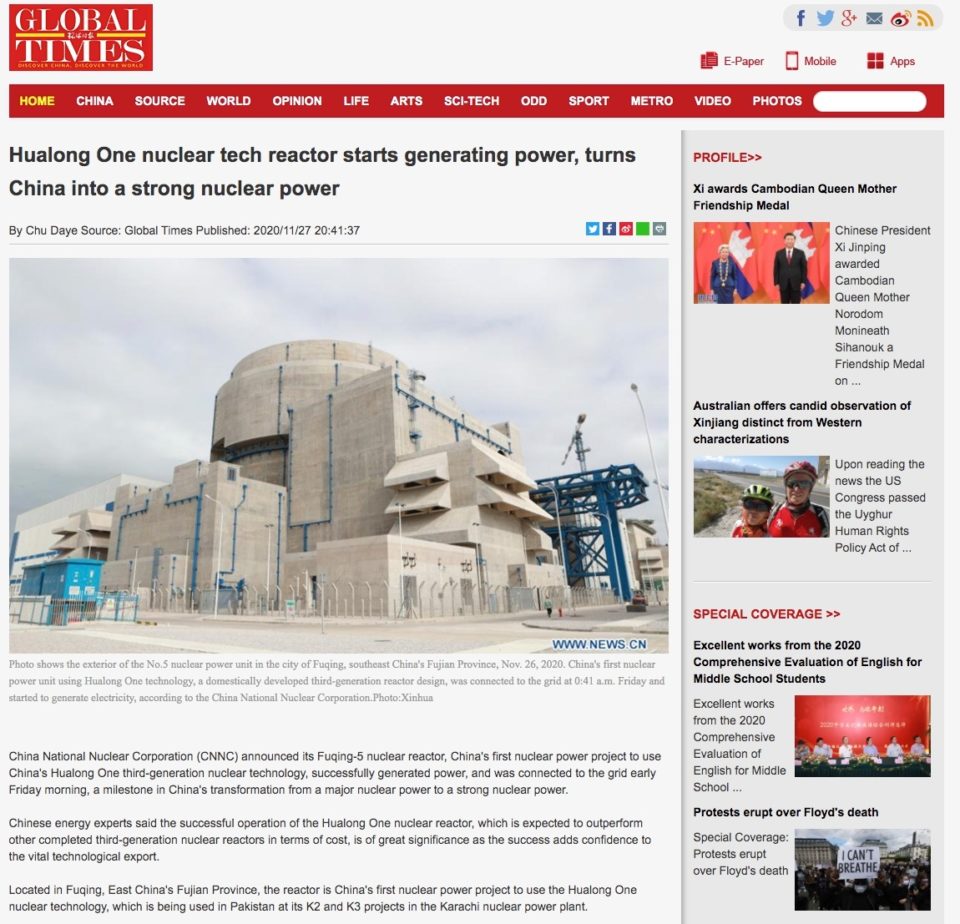

Fuqing-5 nuclear reactor, which is China’s first nuclear power project to use China’s Hualong One third generation nuclear technology, has just been connected to the grid…

Fuqing-5 nuclear reactor, which is China’s first nuclear power project to use China’s Hualong One third generation nuclear technology, has just been connected to the grid…

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

Saudi Aramco has signed a $10-billion agreement to form a joint venture with Norinco, and Panjin Sincen to develop a fully integrated, grassroots refining and petrochemical complex in Panjin…

Saudi Aramco has signed a $10-billion agreement to form a joint venture with Norinco, and Panjin Sincen to develop a fully integrated, grassroots refining and petrochemical complex in Panjin…

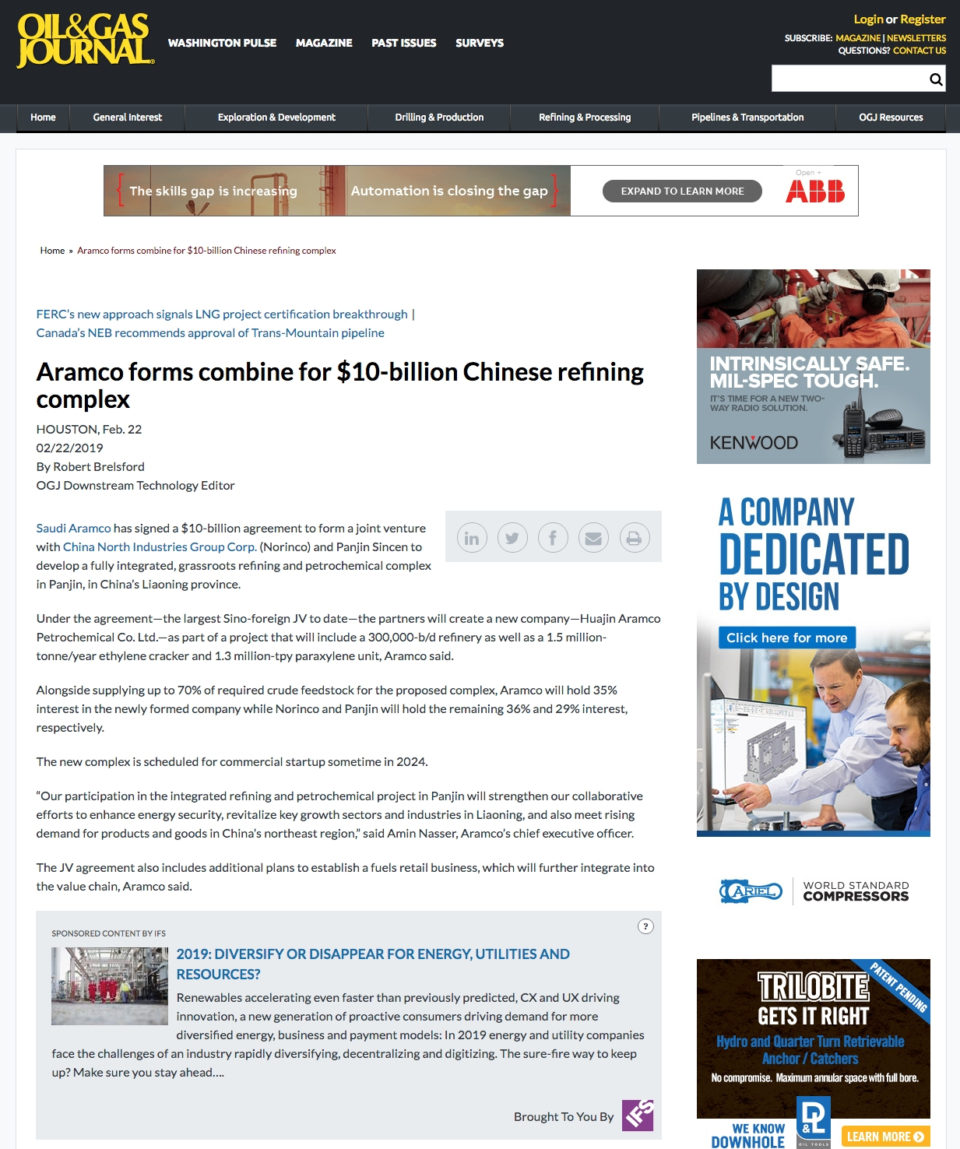

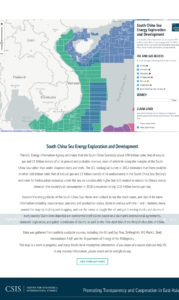

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

The U.S. Energy Information Agency estimates that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves…

According to Argus, Beijing is lining up a $5bn credit line for Venezuela from China Development Bank. It is tied to unspecified gold mining joint ventures and will be used to boost output at upstream joint ventures…

According to Argus, Beijing is lining up a $5bn credit line for Venezuela from China Development Bank. It is tied to unspecified gold mining joint ventures and will be used to boost output at upstream joint ventures…

The risk of declining Chinese demand for oil is worrying Middle East officials more than Iran’s supply curbs resulting from U.S. sanctions.

The risk of declining Chinese demand for oil is worrying Middle East officials more than Iran’s supply curbs resulting from U.S. sanctions.  A Qatari delegation to China, led by Saad Sherida Al-Kaabi, Qatar Petroleum president & CEO and the chairman of the country’s LNG producer, Qatargas, will hold meetings with Chinese energy majors including China National Offshore Oil Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Beijing Gas, among others.

A Qatari delegation to China, led by Saad Sherida Al-Kaabi, Qatar Petroleum president & CEO and the chairman of the country’s LNG producer, Qatargas, will hold meetings with Chinese energy majors including China National Offshore Oil Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Beijing Gas, among others.  China will put an end to the sale of fossil-fuel-powered vehicles – gasoline and diesel – becoming the biggest market to do so in a move that will accelerate the push into the electric car market led by companies including the Chinese BYD Co. and BAIC Motor Corp.

China will put an end to the sale of fossil-fuel-powered vehicles – gasoline and diesel – becoming the biggest market to do so in a move that will accelerate the push into the electric car market led by companies including the Chinese BYD Co. and BAIC Motor Corp.  China aims to build a world-class nuclear energy innovation hub in Shanghai, planning to become a global nuclear forerunner and establishing itself as a nuclear tech leader, high-end facility manufacturer and exporter.

China aims to build a world-class nuclear energy innovation hub in Shanghai, planning to become a global nuclear forerunner and establishing itself as a nuclear tech leader, high-end facility manufacturer and exporter.  A new agreement between the U.S. and China has the potential to alter global LNG trade, opening the door of the world’s largest LNG growth market to the world’s fastest-growing LNG supplier.

A new agreement between the U.S. and China has the potential to alter global LNG trade, opening the door of the world’s largest LNG growth market to the world’s fastest-growing LNG supplier.