US shale: New growth opportunities 11/28/20 • bit.ly/3piCPBC

The US shale industry has gradually started to adapt to the new pricing environment with a series of mergers and acquisitions in the industry that are bringing with them a new optimism…

The US shale industry has gradually started to adapt to the new pricing environment with a series of mergers and acquisitions in the industry that are bringing with them a new optimism…

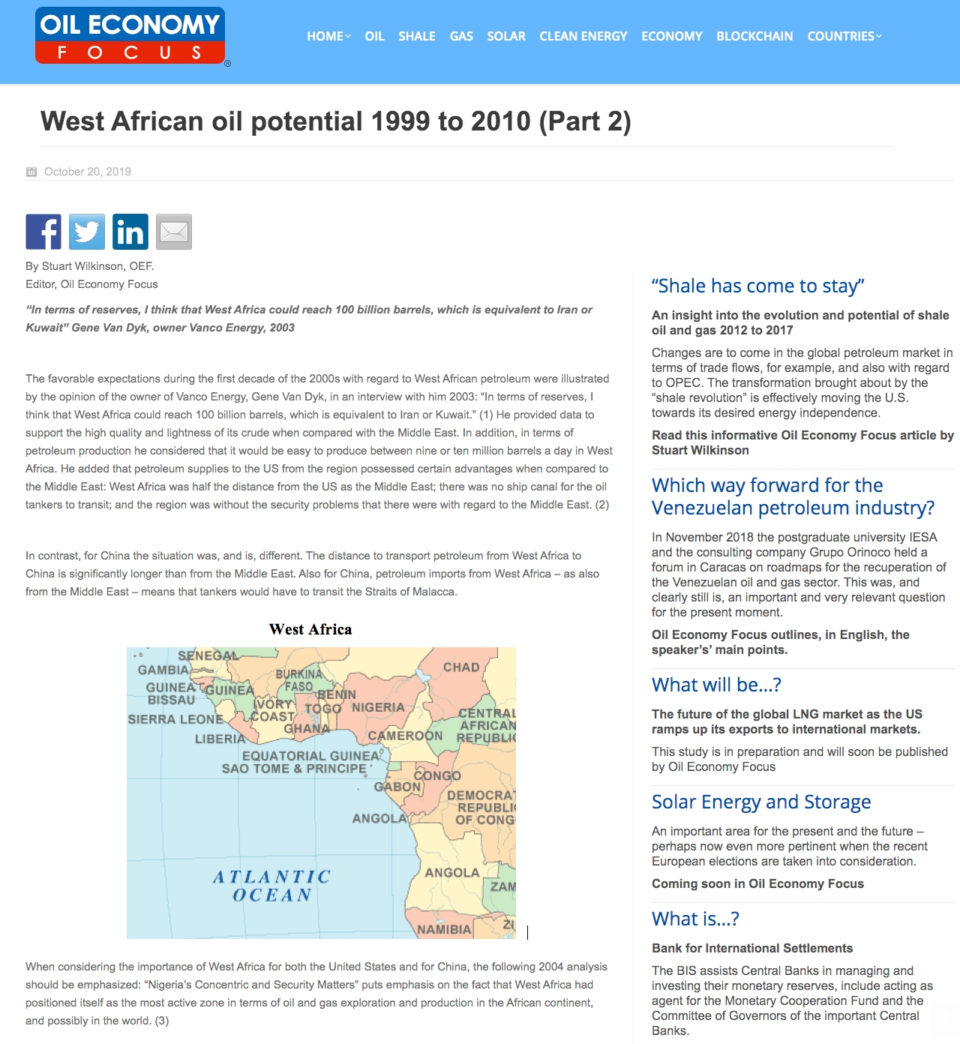

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

There were favorable expectations in the first decade of the 2000s for West African petroleum: the owner of Vanco Energy, Gene Van Dyk, said in 2003: “In terms of reserves, I think that West Africa could reach 100 billion barrels, which is equivalent to Iran or Kuwait”…

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

The euphoria in the United States about West African oil went up in smoke when the shale revolution came… but China keeps on the road of obtaining secure sources of oil supply for its economic growth.

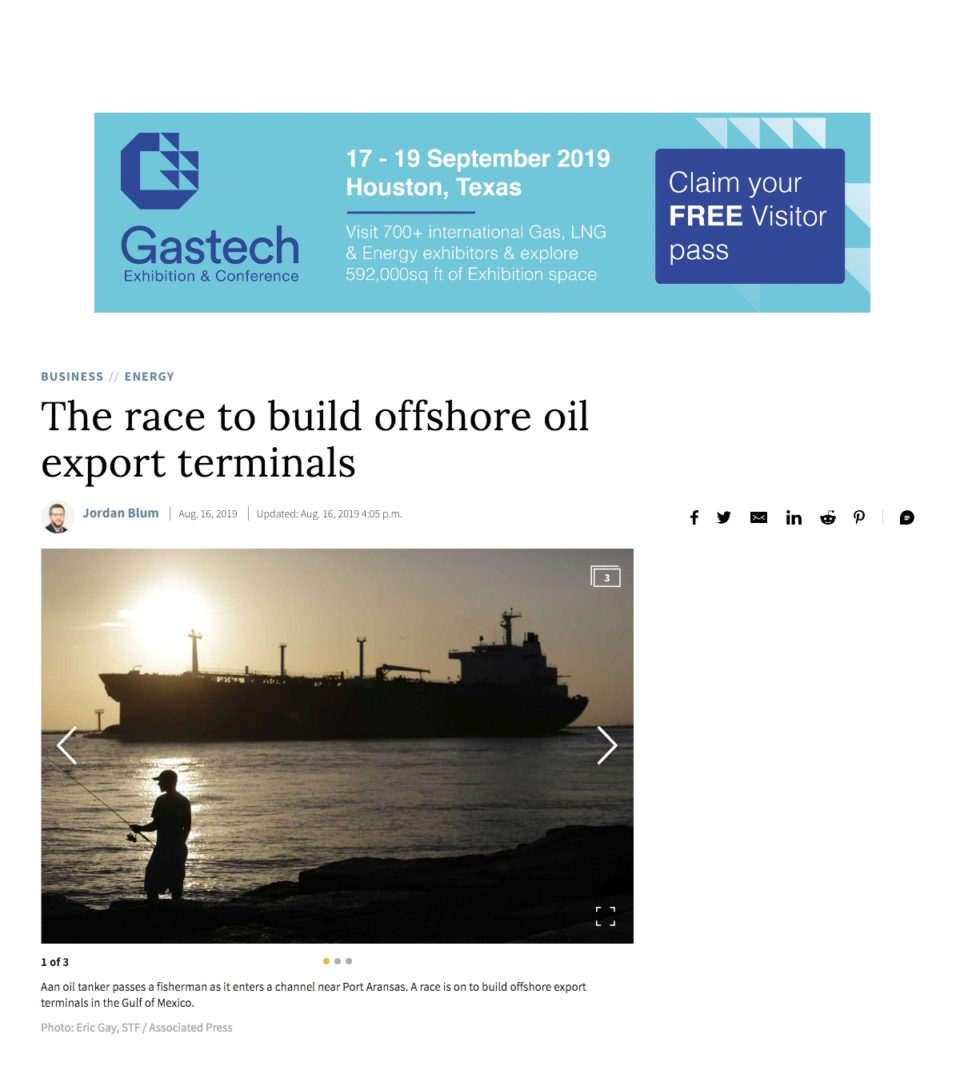

As several pipelines connecting West Texas and the Gulf Cast near completion, various companies have proposed at least eight offshore oil-export terminals…

As several pipelines connecting West Texas and the Gulf Cast near completion, various companies have proposed at least eight offshore oil-export terminals…

Oil drilling and well completions activities are slowing in the Permian Basin because of the lack of pipelines to carry the oil to refining and export hubs…

Oil drilling and well completions activities are slowing in the Permian Basin because of the lack of pipelines to carry the oil to refining and export hubs…

Poland’s state-owned gas company, PGNiG, is currently in preliminary talks with US companies to grab equity stakes in LNG export facilities, so paving the way to the company securing US LNG supplies.

Poland’s state-owned gas company, PGNiG, is currently in preliminary talks with US companies to grab equity stakes in LNG export facilities, so paving the way to the company securing US LNG supplies.

According to Samantha Gross, Fellow, Cross-Brookings Initiative on Energy and Climate, the renaissance in US oil and gas production has been remarkable.

According to Samantha Gross, Fellow, Cross-Brookings Initiative on Energy and Climate, the renaissance in US oil and gas production has been remarkable.

Energy Transfer Partners plans to build a crude pipeline with an initial capacity of up to 600,000 barrels per day from the Permian basin to the Houston Ship Channel and Nederland, Texas.

Energy Transfer Partners plans to build a crude pipeline with an initial capacity of up to 600,000 barrels per day from the Permian basin to the Houston Ship Channel and Nederland, Texas.

US Energy Secretary Rick Perry entered into a “new era” of nuclear power development with France, using the state visit by French President Emmanuel Macron to sign a joint agreement to advance nuclear and clean energy.

US Energy Secretary Rick Perry entered into a “new era” of nuclear power development with France, using the state visit by French President Emmanuel Macron to sign a joint agreement to advance nuclear and clean energy.

U.S. Interior Secretary Ryan Zinke said nearly all of the U.S. outer continental shelf is being considered for drilling, including areas off the coasts of Maine, California, Florida and Alaska.

U.S. Interior Secretary Ryan Zinke said nearly all of the U.S. outer continental shelf is being considered for drilling, including areas off the coasts of Maine, California, Florida and Alaska.

Gregg Davis, the CEO of D3 Energy LLC, has started an initiative to increase awareness of U.S. conventional resources through a new association: the Conventional Oil Producers of America (COPA).

Gregg Davis, the CEO of D3 Energy LLC, has started an initiative to increase awareness of U.S. conventional resources through a new association: the Conventional Oil Producers of America (COPA).

The cost of generating power from onshore wind has fallen by around a quarter since 2010; solar photovoltaic (PV) electricity costs have fallen by 73 per cent in that time and are expected to halve by 2020.

The cost of generating power from onshore wind has fallen by around a quarter since 2010; solar photovoltaic (PV) electricity costs have fallen by 73 per cent in that time and are expected to halve by 2020.

The U.S. has now become a net exporter of natural gas on an annual basis for the first time since at least 1957.

The U.S. has now become a net exporter of natural gas on an annual basis for the first time since at least 1957. Mortality rates in the six Pennsylvania counties with the most Marcellus Shale development have declined or remained stable since shale production began in the region, according to a new report.

Mortality rates in the six Pennsylvania counties with the most Marcellus Shale development have declined or remained stable since shale production began in the region, according to a new report. Oil explorers took advantage of a market rally to lock in prices for almost 1 million barrels a day’s worth of future output.

Oil explorers took advantage of a market rally to lock in prices for almost 1 million barrels a day’s worth of future output. The U.S. Interior Department will hold a lease sale for land in a federal reserve in northern Alaska to oil and gas drillers.

The U.S. Interior Department will hold a lease sale for land in a federal reserve in northern Alaska to oil and gas drillers. America’s drillers are looking for a cheaper and quicker route to Asian markets than the Panama Canal.

America’s drillers are looking for a cheaper and quicker route to Asian markets than the Panama Canal.  Iran’s oil minister, Bijan Zanganeh, has said that President Trump should allow American oil firms to do business in the Islamic Republic: “If they want to, we are ready to negotiate American companies.

Iran’s oil minister, Bijan Zanganeh, has said that President Trump should allow American oil firms to do business in the Islamic Republic: “If they want to, we are ready to negotiate American companies.