High regional gas prices in South America, most notably Argentina, are attracting US exports of domestically produced LNG, with more than 70% of landed cargoes arriving on the continent so far this year. South America has offered the most profitable destination for US exports compared with Europe, the Middle East and Asia. Regional gas markets, particularly in Argentina, are experiencing elevated prices. In an effort to stem the decline in gas production, the Argentine president cut domestic subsidies in December. His administration hopes that higher wellhead prices will revive production in older fields and stimulate new production, particularly in the Vaca Muerta Basin where large untapped volumes remain locked in shale and tight gas reservoirs. In March and April the first and second US cargoes to arrive in South America landed in Brazil, and since April, all eight US cargoes exported to the region have landed in the Southern Cone nations of Argentina and Chile.

High regional gas prices in South America, most notably Argentina, are attracting US exports of domestically produced LNG, with more than 70% of landed cargoes arriving on the continent so far this year. South America has offered the most profitable destination for US exports compared with Europe, the Middle East and Asia. Regional gas markets, particularly in Argentina, are experiencing elevated prices. In an effort to stem the decline in gas production, the Argentine president cut domestic subsidies in December. His administration hopes that higher wellhead prices will revive production in older fields and stimulate new production, particularly in the Vaca Muerta Basin where large untapped volumes remain locked in shale and tight gas reservoirs. In March and April the first and second US cargoes to arrive in South America landed in Brazil, and since April, all eight US cargoes exported to the region have landed in the Southern Cone nations of Argentina and Chile.

Chief Executive Officer, Economic Associates, Ayo Teriba argues that Nigeria could have avoided the economic recession, devaluation and inflation that accompanied the loss in foreign exchange revenue due to decline in crude oil price between 2014 and 2016

Chief Executive Officer, Economic Associates, Ayo Teriba argues that Nigeria could have avoided the economic recession, devaluation and inflation that accompanied the loss in foreign exchange revenue due to decline in crude oil price between 2014 and 2016

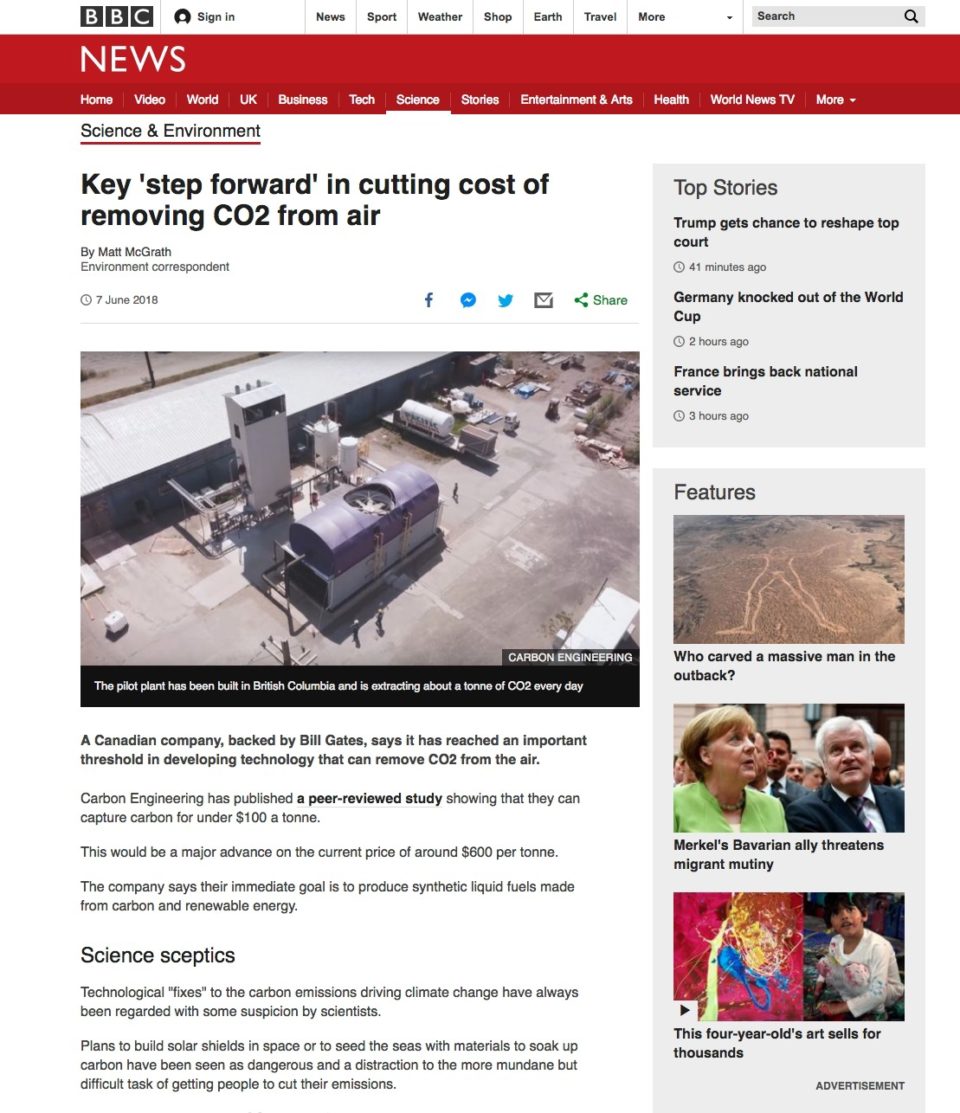

The Canadian company, Carbon Engineering, has indicated that the technology it has developed can capture carbon directly from the air for under $100 a tonne, rather than the current price of $600 per tonne…

The Canadian company, Carbon Engineering, has indicated that the technology it has developed can capture carbon directly from the air for under $100 a tonne, rather than the current price of $600 per tonne…

Oil prices could rally to $100 a barrel next year, a level not seen since 2014, as supply risks in Venezuela and Iran strain global markets, according to Bank of America.

Oil prices could rally to $100 a barrel next year, a level not seen since 2014, as supply risks in Venezuela and Iran strain global markets, according to Bank of America.

Flashpoints in the Middle East and North Africa have already been the main focus of attention this year and have the potential to cause fresh price volatility, particularly as global spare capacity thins and economic recovery stokes demand growth.

Flashpoints in the Middle East and North Africa have already been the main focus of attention this year and have the potential to cause fresh price volatility, particularly as global spare capacity thins and economic recovery stokes demand growth. On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20.

On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20.