First quarter 2020 may need OPEC intervention 09/10/19 • bit.ly/2lJQaad • lweb.es/a?a=7993

According to Rystad Energy, “Economic recession risk and further escalation of the U.S.-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” said the head of oil market analysis at the company…

According to Rystad Energy, “Economic recession risk and further escalation of the U.S.-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” said the head of oil market analysis at the company…

Russia’s mainstream oil producers Rosneft, Gazprom and Lukoil increased pressure on Russia’s president Vladimir Putin to slow down preparations for the expected marriage with OPEC…

Russia’s mainstream oil producers Rosneft, Gazprom and Lukoil increased pressure on Russia’s president Vladimir Putin to slow down preparations for the expected marriage with OPEC…

The risk of declining Chinese demand for oil is worrying Middle East officials more than Iran’s supply curbs resulting from U.S. sanctions.

The risk of declining Chinese demand for oil is worrying Middle East officials more than Iran’s supply curbs resulting from U.S. sanctions.  Oil explorers took advantage of a market rally to lock in prices for almost 1 million barrels a day’s worth of future output.

Oil explorers took advantage of a market rally to lock in prices for almost 1 million barrels a day’s worth of future output. Oil climbed above $61 a barrel for the first time in two and a half years, surpassing a crucial threshold for spurring new shale drilling.

Oil climbed above $61 a barrel for the first time in two and a half years, surpassing a crucial threshold for spurring new shale drilling.  Oil sands will be second to shale as the biggest contributor to global supply growth over the next two years with half a million barrels a day of production scheduled to enter the market. The drive for efficiency, along with lower gas prices, has driven the average break-even operating cost on thermal oil sands to less than $10 a barrel from about $15 in 2014, and expanding or building a site requires a price of $50 to $60. Western Canada’s oil sands production will rise by 720,000 barrels a day to 3.12 million in 2020.

Oil sands will be second to shale as the biggest contributor to global supply growth over the next two years with half a million barrels a day of production scheduled to enter the market. The drive for efficiency, along with lower gas prices, has driven the average break-even operating cost on thermal oil sands to less than $10 a barrel from about $15 in 2014, and expanding or building a site requires a price of $50 to $60. Western Canada’s oil sands production will rise by 720,000 barrels a day to 3.12 million in 2020. On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20.

On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20. Goldman Sachs says that OPEC must increase output cuts aimed at shrinking a global glut with little public announcement in order to jolt investors. Without such action and no evidence of sustained declines in inventories as well as U.S. drilling activity, prices could slump below $40. “We continue to believe that there is another opportunity for OPEC to increase the cuts, but that this should be done in a “shock and awe” manner, with little public announcement.” Deeper cuts are currently not on the agenda, according to OPEC Secretary-General Mohammad Barkindo.

Goldman Sachs says that OPEC must increase output cuts aimed at shrinking a global glut with little public announcement in order to jolt investors. Without such action and no evidence of sustained declines in inventories as well as U.S. drilling activity, prices could slump below $40. “We continue to believe that there is another opportunity for OPEC to increase the cuts, but that this should be done in a “shock and awe” manner, with little public announcement.” Deeper cuts are currently not on the agenda, according to OPEC Secretary-General Mohammad Barkindo. Oil traders are storing more oil at sea amid swelling output in the Atlantic region, a sign the market is far from the kind of re-balancing that OPEC would have hoped for. The amount of oil stored in tankers reached a 2017 high of 111.9 million barrels early June, and higher volumes of storage in the North Sea, Singapore and Iran account for most of the increase. Oil in floating storage has been building at a rate of about 800,000 barrels a day since early May and continues to increase, said a Morgan Stanley report.

Oil traders are storing more oil at sea amid swelling output in the Atlantic region, a sign the market is far from the kind of re-balancing that OPEC would have hoped for. The amount of oil stored in tankers reached a 2017 high of 111.9 million barrels early June, and higher volumes of storage in the North Sea, Singapore and Iran account for most of the increase. Oil in floating storage has been building at a rate of about 800,000 barrels a day since early May and continues to increase, said a Morgan Stanley report. The price of oil could fall to $30 next year and stay at that level for about two years, according to Fereidun Fesharaki, chairman of consultants FGE. He said that the current level of cuts implemented by OPEC should keep the oil price around $50 a barrel for the remainder of 2017, but a failure to deepen these cuts would lower prices. Fesharaki stated that the key question was whether there was a limit to US Light Tight Oil production, or whether a boom in shale oil production in Argentina would occur.

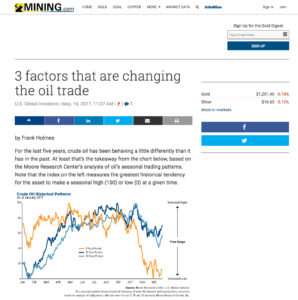

The price of oil could fall to $30 next year and stay at that level for about two years, according to Fereidun Fesharaki, chairman of consultants FGE. He said that the current level of cuts implemented by OPEC should keep the oil price around $50 a barrel for the remainder of 2017, but a failure to deepen these cuts would lower prices. Fesharaki stated that the key question was whether there was a limit to US Light Tight Oil production, or whether a boom in shale oil production in Argentina would occur. This article considers three principal drivers for the oil trade: technology, weather and OPEC policy: • Fracking technology is highly influential: The graphs “Crude oil historical patterns”, showing changes over the last 5 years compared to the last 15 and 30 years, and the graph “US Crude oil production” from1983 to 2017, show the relevant impact.• Extreme weather: A growing number of weather events costing $1 billion have been experienced, as well as significant losses in production. • OPEC strategy is less effective now… The graphic “Does OPEC policy influence prices anymore?” asks a very pertinent question.

This article considers three principal drivers for the oil trade: technology, weather and OPEC policy: • Fracking technology is highly influential: The graphs “Crude oil historical patterns”, showing changes over the last 5 years compared to the last 15 and 30 years, and the graph “US Crude oil production” from1983 to 2017, show the relevant impact.• Extreme weather: A growing number of weather events costing $1 billion have been experienced, as well as significant losses in production. • OPEC strategy is less effective now… The graphic “Does OPEC policy influence prices anymore?” asks a very pertinent question. OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil.

OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil.