Next Generation Technology To Double Oil And Gas Reserves By 2050 09/10/17 •lweb.es/f3759 •bit.ly/2AzDWUN

Next-generation technology will connect workers, suppliers, customers and assets through a reimagined business model. By leveraging Internet of Things enabled devices, the oil industry could turn insight into action. By using connected instruments from wellheads or pipelines to an integrated data repository, data sources will have increased insight into production. A cloud-based solution that aligns with talent as well as procurement provides integrated support to the supplier network, creating increased efficiency and cost savings. By optimization oil companies will have more time and resources to invest in technology to help increase oil reserves.

Next-generation technology will connect workers, suppliers, customers and assets through a reimagined business model. By leveraging Internet of Things enabled devices, the oil industry could turn insight into action. By using connected instruments from wellheads or pipelines to an integrated data repository, data sources will have increased insight into production. A cloud-based solution that aligns with talent as well as procurement provides integrated support to the supplier network, creating increased efficiency and cost savings. By optimization oil companies will have more time and resources to invest in technology to help increase oil reserves.

Jonathan Chanis, vice president of policy at Securing America’s Future Energy considers that an oil supply shortage and price spikes of $80-$100 a barrel could hit the global oil market by the 2020s if producers do not fund major projects soon. He adds that rising US tight oil supply will not be able to stop this trend. Investment declined 40% in 2015 and 2016 and has been flat so far this year, he said. The number of megaprojects approved in the next year to two years will determine if that shortage arrives.

Jonathan Chanis, vice president of policy at Securing America’s Future Energy considers that an oil supply shortage and price spikes of $80-$100 a barrel could hit the global oil market by the 2020s if producers do not fund major projects soon. He adds that rising US tight oil supply will not be able to stop this trend. Investment declined 40% in 2015 and 2016 and has been flat so far this year, he said. The number of megaprojects approved in the next year to two years will determine if that shortage arrives. ExxonMobil has discovered more oil on the Stabroek block offshore Guyana, northeast Latin America, with the Turbot-1 well. Turbot is ExxonMobil’s latest discovery to date in the country, adding to previous discoveries at Liza, Payara, Snoek, and Liza Deep. Steve Greenlee, president of ExxonMobil Exploration Co., said on this that: “The results from this latest well further illustrate the tremendous potential we see from our exploration activities offshore Guyana.” Eventhough the country is not an oil producer at the moment Woodmac expects production to be around 350,000 to 400,000 barrels a day by 2026.

ExxonMobil has discovered more oil on the Stabroek block offshore Guyana, northeast Latin America, with the Turbot-1 well. Turbot is ExxonMobil’s latest discovery to date in the country, adding to previous discoveries at Liza, Payara, Snoek, and Liza Deep. Steve Greenlee, president of ExxonMobil Exploration Co., said on this that: “The results from this latest well further illustrate the tremendous potential we see from our exploration activities offshore Guyana.” Eventhough the country is not an oil producer at the moment Woodmac expects production to be around 350,000 to 400,000 barrels a day by 2026.

While there’s a risk oil may slide below $30 as it is displaced by alternative energy sources, it will still be used to make petrochemicals, said Ye Jianming, the head of CEFC, the Chinese company that has bought a $9 billion stake in Rosneft. CEFC plans to work with Rosneft and Abu Dhabi to produce petrochemicals for the Chinese market, he added. The company currently has more than 80 million metric tons of foreign crude oil equity, of which 42 million tons is from Rosneft, 13 million tons is from Abu Dhabi and the remaining from Chad and Kazakhstan.

While there’s a risk oil may slide below $30 as it is displaced by alternative energy sources, it will still be used to make petrochemicals, said Ye Jianming, the head of CEFC, the Chinese company that has bought a $9 billion stake in Rosneft. CEFC plans to work with Rosneft and Abu Dhabi to produce petrochemicals for the Chinese market, he added. The company currently has more than 80 million metric tons of foreign crude oil equity, of which 42 million tons is from Rosneft, 13 million tons is from Abu Dhabi and the remaining from Chad and Kazakhstan. The U.S. company prior to the auction. Exxon Mobil has vastly expanded its presence in Brazil by winning 10 blocks in the country’s 14th round of bidding for oil exploration and production rights. Previously the company was among the few oil majors without a presence in the exploration of the recently discovered large offshore fields in Brazil. Exxon Mobil took six blocks in consortia with state-controlled oil giant Petrobras in the promising offshore Campos basin. The auction was Brazil’s 14th round for blocks outside of the coveted pre-salt area and should gauge appetite for the country’s second and third pre-salt rounds.

The U.S. company prior to the auction. Exxon Mobil has vastly expanded its presence in Brazil by winning 10 blocks in the country’s 14th round of bidding for oil exploration and production rights. Previously the company was among the few oil majors without a presence in the exploration of the recently discovered large offshore fields in Brazil. Exxon Mobil took six blocks in consortia with state-controlled oil giant Petrobras in the promising offshore Campos basin. The auction was Brazil’s 14th round for blocks outside of the coveted pre-salt area and should gauge appetite for the country’s second and third pre-salt rounds. “U.S. crude is becoming more and more popular,” said the world’s biggest refiner Sinopec. There are three reasons for Asian oil buyers’ interest in U.S. crude: first, it fits the configuration of Asian refineries, which like to process high quality so-called light sweet crude that yields more petroleum products such as gasoline and diesel. Second, it’s cheap, with WTI trading at times at a steep discount to other oil benchmarks. Third, the cargoes are bought on a spot basis, giving refiners flexibility to complement their more traditional Middle Eastern supplies that are sourced via long-term contracts.

“U.S. crude is becoming more and more popular,” said the world’s biggest refiner Sinopec. There are three reasons for Asian oil buyers’ interest in U.S. crude: first, it fits the configuration of Asian refineries, which like to process high quality so-called light sweet crude that yields more petroleum products such as gasoline and diesel. Second, it’s cheap, with WTI trading at times at a steep discount to other oil benchmarks. Third, the cargoes are bought on a spot basis, giving refiners flexibility to complement their more traditional Middle Eastern supplies that are sourced via long-term contracts. France is to ban all production and exploration of oil and natural gas by 2040 on the country’s mainland and overseas territories.

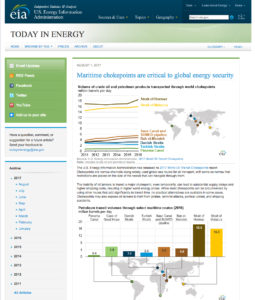

France is to ban all production and exploration of oil and natural gas by 2040 on the country’s mainland and overseas territories.  The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints.

The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints. Output has fallen in both OPEC and non-OPEC Latin American countries leading refiners even in China to look to Alberta’s oil sands to fill the gap. This interest has boosted the price for heavy Western Canada Select, Canadian heavy oil being an easy substitute for Middle Eastern and Latin American grades. The discount for Canadian oil delivered to the U.S. storage hub in Cushing is around $5 a barrel below U.S. crude. Canadian barrels could supply refineries in Sweeney, Texas, and St. Charles, Louisiana, where Venezuela accounts for the majority of imports.

Output has fallen in both OPEC and non-OPEC Latin American countries leading refiners even in China to look to Alberta’s oil sands to fill the gap. This interest has boosted the price for heavy Western Canada Select, Canadian heavy oil being an easy substitute for Middle Eastern and Latin American grades. The discount for Canadian oil delivered to the U.S. storage hub in Cushing is around $5 a barrel below U.S. crude. Canadian barrels could supply refineries in Sweeney, Texas, and St. Charles, Louisiana, where Venezuela accounts for the majority of imports. PwC Q2 report: $37.01 billion was the third-highest Q2 value of the past 8 years for U.S. O&G mergers and acquisitions.

PwC Q2 report: $37.01 billion was the third-highest Q2 value of the past 8 years for U.S. O&G mergers and acquisitions.  Oil sands will be second to shale as the biggest contributor to global supply growth over the next two years with half a million barrels a day of production scheduled to enter the market. The drive for efficiency, along with lower gas prices, has driven the average break-even operating cost on thermal oil sands to less than $10 a barrel from about $15 in 2014, and expanding or building a site requires a price of $50 to $60. Western Canada’s oil sands production will rise by 720,000 barrels a day to 3.12 million in 2020.

Oil sands will be second to shale as the biggest contributor to global supply growth over the next two years with half a million barrels a day of production scheduled to enter the market. The drive for efficiency, along with lower gas prices, has driven the average break-even operating cost on thermal oil sands to less than $10 a barrel from about $15 in 2014, and expanding or building a site requires a price of $50 to $60. Western Canada’s oil sands production will rise by 720,000 barrels a day to 3.12 million in 2020. India is keen to rapidly develop Iran’s Chabahar Port, a strategic facility that New Delhi hopes will open up opportunities to Indian companies wanting access to Iran, Central Asia, Russia and other regions beyond. Chabahar sits on the Gulf of Oman near the Iranian border with Pakistan and promises India the possibility of direct sea access from its western coast. India, which imports 80% of its crude oil needs, has a long-standing relationship with Iran, especially in the energy sector. India is the second-biggest buyer of oil from Iran, after China.

India is keen to rapidly develop Iran’s Chabahar Port, a strategic facility that New Delhi hopes will open up opportunities to Indian companies wanting access to Iran, Central Asia, Russia and other regions beyond. Chabahar sits on the Gulf of Oman near the Iranian border with Pakistan and promises India the possibility of direct sea access from its western coast. India, which imports 80% of its crude oil needs, has a long-standing relationship with Iran, especially in the energy sector. India is the second-biggest buyer of oil from Iran, after China.