Moody’s: Positive Outlook For Global Independent E&P Firms 05/23/17 •lweb.es/f2845 •bit.ly/2s2mwdG

The outlook for global independent exploration and production firms remains positive, according to Moody’s. Increased oil and natural gas production, higher commodity prices, and moderate cost increases will help independent business’ earnings grow at a healthy pace over the next 12-18 months. The global E&P sector EBITDA – Earnings Before Interest, Taxation, Depreciation and Amortization – is expected to grow by 20-30% in 2017, following declines of about 25% in 2016 and a roughly 45% drop in 2015. The sector’s oil and natural gas production will rise about 5%, and mergers and acquisitions will be robust.

The outlook for global independent exploration and production firms remains positive, according to Moody’s. Increased oil and natural gas production, higher commodity prices, and moderate cost increases will help independent business’ earnings grow at a healthy pace over the next 12-18 months. The global E&P sector EBITDA – Earnings Before Interest, Taxation, Depreciation and Amortization – is expected to grow by 20-30% in 2017, following declines of about 25% in 2016 and a roughly 45% drop in 2015. The sector’s oil and natural gas production will rise about 5%, and mergers and acquisitions will be robust.

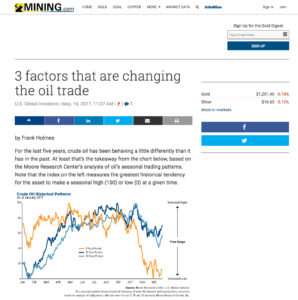

This article considers three principal drivers for the oil trade: technology, weather and OPEC policy: • Fracking technology is highly influential: The graphs “Crude oil historical patterns”, showing changes over the last 5 years compared to the last 15 and 30 years, and the graph “US Crude oil production” from1983 to 2017, show the relevant impact.• Extreme weather: A growing number of weather events costing $1 billion have been experienced, as well as significant losses in production. • OPEC strategy is less effective now… The graphic “Does OPEC policy influence prices anymore?” asks a very pertinent question.

This article considers three principal drivers for the oil trade: technology, weather and OPEC policy: • Fracking technology is highly influential: The graphs “Crude oil historical patterns”, showing changes over the last 5 years compared to the last 15 and 30 years, and the graph “US Crude oil production” from1983 to 2017, show the relevant impact.• Extreme weather: A growing number of weather events costing $1 billion have been experienced, as well as significant losses in production. • OPEC strategy is less effective now… The graphic “Does OPEC policy influence prices anymore?” asks a very pertinent question. OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil.

OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil. The worst crude-market crash in a generation has propelled energy companies into the digital world. Now they’re using DNA sequencing to track crude molecules and mapping buried streams with imaging software. Robots are fitting pipes together. Roughnecks consult mobile apps for drilling-direction advice. Algorithms adjust the extraction flow based on computer monitoring hundreds of feet below. “You’ve had a clear shift occur where onshore North America for the first time in recent history has become a technology play.” said Tom Curran, an energy analyst at FBR Capital Markets.

The worst crude-market crash in a generation has propelled energy companies into the digital world. Now they’re using DNA sequencing to track crude molecules and mapping buried streams with imaging software. Robots are fitting pipes together. Roughnecks consult mobile apps for drilling-direction advice. Algorithms adjust the extraction flow based on computer monitoring hundreds of feet below. “You’ve had a clear shift occur where onshore North America for the first time in recent history has become a technology play.” said Tom Curran, an energy analyst at FBR Capital Markets. According to an Arab Monetary Fund analysis, most of the Arab oil-exporting countries have had to readjust owing to unfavorable global economic developments.

According to an Arab Monetary Fund analysis, most of the Arab oil-exporting countries have had to readjust owing to unfavorable global economic developments.  Now is the halfway point for the 6-month oil production cuts agreed by OPEC and the 11 other oil producing countries, and the market is very close to balance. The International Energy Agency has observed that “Even at this midway point, we can consider what comes next … extending their output cuts beyond the 6-month mark would be bigger implied stock draws. This would provide further support to prices, which in turn would offer further encouragement to the US shale oil sector and other producers.”

Now is the halfway point for the 6-month oil production cuts agreed by OPEC and the 11 other oil producing countries, and the market is very close to balance. The International Energy Agency has observed that “Even at this midway point, we can consider what comes next … extending their output cuts beyond the 6-month mark would be bigger implied stock draws. This would provide further support to prices, which in turn would offer further encouragement to the US shale oil sector and other producers.” “While the Petra Nova project will certainly benefit Texas, it also demonstrates that clean coal technologies can have a meaningful and positive impact on the nation’s energy security and economic growth,” said Energy Secretary Rick Perry.

“While the Petra Nova project will certainly benefit Texas, it also demonstrates that clean coal technologies can have a meaningful and positive impact on the nation’s energy security and economic growth,” said Energy Secretary Rick Perry.  30 crude and natural gas projects are expected to start operations in the North Sea by 2020. The UK will lead with a total of 19 projects, followed by Norway with 10 and Denmark with a single project, according to GlobalData. The total recoverable reserves for these projects are expected to stand at 5.2 billion barrels of oil equivalent. The planned projects in the North Sea They are expected to require a total capital expenditure of $56.7 billion, of which over half (54%) is expected to be spent between 2017 and 2020.

30 crude and natural gas projects are expected to start operations in the North Sea by 2020. The UK will lead with a total of 19 projects, followed by Norway with 10 and Denmark with a single project, according to GlobalData. The total recoverable reserves for these projects are expected to stand at 5.2 billion barrels of oil equivalent. The planned projects in the North Sea They are expected to require a total capital expenditure of $56.7 billion, of which over half (54%) is expected to be spent between 2017 and 2020. In the Middle East North Africa region $622 billion worth of development is planned in the energy sector for the next five years. The power sector accounts for the largest share at $207 billion, with the oil and gas sector at $195 billion and $159 billion respectively. Leading the drive will be Saudi Arabia, and Iraq and Iran will play catch-up. Algeria will pump billions into its upstream sector, and much is expected from Egypt’s recent gas. Renewable-energy projects will be at the forefront of efforts to meet rising power demand in Morocco, Tunisia and Jordan.

In the Middle East North Africa region $622 billion worth of development is planned in the energy sector for the next five years. The power sector accounts for the largest share at $207 billion, with the oil and gas sector at $195 billion and $159 billion respectively. Leading the drive will be Saudi Arabia, and Iraq and Iran will play catch-up. Algeria will pump billions into its upstream sector, and much is expected from Egypt’s recent gas. Renewable-energy projects will be at the forefront of efforts to meet rising power demand in Morocco, Tunisia and Jordan.