Could Crude Fall Below $30? CEFC Head Ye Jianming 03/10/17 •lweb.es/f3762 •bit.ly/2jZgfxp

While there’s a risk oil may slide below $30 as it is displaced by alternative energy sources, it will still be used to make petrochemicals, said Ye Jianming, the head of CEFC, the Chinese company that has bought a $9 billion stake in Rosneft. CEFC plans to work with Rosneft and Abu Dhabi to produce petrochemicals for the Chinese market, he added. The company currently has more than 80 million metric tons of foreign crude oil equity, of which 42 million tons is from Rosneft, 13 million tons is from Abu Dhabi and the remaining from Chad and Kazakhstan.

While there’s a risk oil may slide below $30 as it is displaced by alternative energy sources, it will still be used to make petrochemicals, said Ye Jianming, the head of CEFC, the Chinese company that has bought a $9 billion stake in Rosneft. CEFC plans to work with Rosneft and Abu Dhabi to produce petrochemicals for the Chinese market, he added. The company currently has more than 80 million metric tons of foreign crude oil equity, of which 42 million tons is from Rosneft, 13 million tons is from Abu Dhabi and the remaining from Chad and Kazakhstan.

According to the international natural gas association Cedigaz, global liquid natural gas capacity is expected to peak at 387 million tons a year by 2021-2022 from 288 million tons this year at existing or under-construction plants.

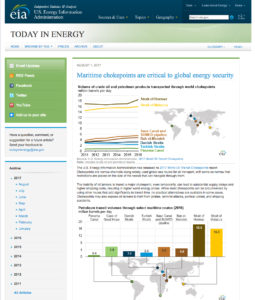

According to the international natural gas association Cedigaz, global liquid natural gas capacity is expected to peak at 387 million tons a year by 2021-2022 from 288 million tons this year at existing or under-construction plants.  The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints.

The inability of oil tankers to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. While most chokepoints can be circumvented by using other routes – adding significantly to transit time, no practical alternatives are available in some cases. Some chokepoints, furthermore, have restrictions on vessel size. By volume of oil transit, the Strait of Hormuz and the Strait of Malacca are the world’s most important strategic chokepoints, with the Cape of Good Hope route being a potential alternative for certain chokepoints. Output has fallen in both OPEC and non-OPEC Latin American countries leading refiners even in China to look to Alberta’s oil sands to fill the gap. This interest has boosted the price for heavy Western Canada Select, Canadian heavy oil being an easy substitute for Middle Eastern and Latin American grades. The discount for Canadian oil delivered to the U.S. storage hub in Cushing is around $5 a barrel below U.S. crude. Canadian barrels could supply refineries in Sweeney, Texas, and St. Charles, Louisiana, where Venezuela accounts for the majority of imports.

Output has fallen in both OPEC and non-OPEC Latin American countries leading refiners even in China to look to Alberta’s oil sands to fill the gap. This interest has boosted the price for heavy Western Canada Select, Canadian heavy oil being an easy substitute for Middle Eastern and Latin American grades. The discount for Canadian oil delivered to the U.S. storage hub in Cushing is around $5 a barrel below U.S. crude. Canadian barrels could supply refineries in Sweeney, Texas, and St. Charles, Louisiana, where Venezuela accounts for the majority of imports. On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20.

On simple accounting terms Saudi Arabia, Iraq and Iran can generate profits with oil prices at $20 to $40 per barrel. U.S. shale by contrast requires about $50 to $55 per barrel. If one looks at the fiscal break-even price, OPEC producers require an estimated $70 per barrel this year, higher than the $40 to $60 required by listed energy companies to fund capital expenditure and dividends. With respect to external break-evens, i.e. the oil prices needed to foot import bills, the spectrum is wide: Libya needs $140 a barrel and Norway needing just $20. Goldman Sachs says that OPEC must increase output cuts aimed at shrinking a global glut with little public announcement in order to jolt investors. Without such action and no evidence of sustained declines in inventories as well as U.S. drilling activity, prices could slump below $40. “We continue to believe that there is another opportunity for OPEC to increase the cuts, but that this should be done in a “shock and awe” manner, with little public announcement.” Deeper cuts are currently not on the agenda, according to OPEC Secretary-General Mohammad Barkindo.

Goldman Sachs says that OPEC must increase output cuts aimed at shrinking a global glut with little public announcement in order to jolt investors. Without such action and no evidence of sustained declines in inventories as well as U.S. drilling activity, prices could slump below $40. “We continue to believe that there is another opportunity for OPEC to increase the cuts, but that this should be done in a “shock and awe” manner, with little public announcement.” Deeper cuts are currently not on the agenda, according to OPEC Secretary-General Mohammad Barkindo. Oil traders are storing more oil at sea amid swelling output in the Atlantic region, a sign the market is far from the kind of re-balancing that OPEC would have hoped for. The amount of oil stored in tankers reached a 2017 high of 111.9 million barrels early June, and higher volumes of storage in the North Sea, Singapore and Iran account for most of the increase. Oil in floating storage has been building at a rate of about 800,000 barrels a day since early May and continues to increase, said a Morgan Stanley report.

Oil traders are storing more oil at sea amid swelling output in the Atlantic region, a sign the market is far from the kind of re-balancing that OPEC would have hoped for. The amount of oil stored in tankers reached a 2017 high of 111.9 million barrels early June, and higher volumes of storage in the North Sea, Singapore and Iran account for most of the increase. Oil in floating storage has been building at a rate of about 800,000 barrels a day since early May and continues to increase, said a Morgan Stanley report. The price of oil could fall to $30 next year and stay at that level for about two years, according to Fereidun Fesharaki, chairman of consultants FGE. He said that the current level of cuts implemented by OPEC should keep the oil price around $50 a barrel for the remainder of 2017, but a failure to deepen these cuts would lower prices. Fesharaki stated that the key question was whether there was a limit to US Light Tight Oil production, or whether a boom in shale oil production in Argentina would occur.

The price of oil could fall to $30 next year and stay at that level for about two years, according to Fereidun Fesharaki, chairman of consultants FGE. He said that the current level of cuts implemented by OPEC should keep the oil price around $50 a barrel for the remainder of 2017, but a failure to deepen these cuts would lower prices. Fesharaki stated that the key question was whether there was a limit to US Light Tight Oil production, or whether a boom in shale oil production in Argentina would occur. According to the 2017 BP Statistical Review, rapid growth and improving prosperity mean growth in energy demand is increasingly coming from developing economies, particularly within Asia, rather than from traditional markets in the OECD. However, the drive to improve energy efficiency is causing global energy consumption overall to decelerate. Global carbon emissions are improving, and this can be traced back to the changes in the pace and pattern of economic growth and energy consumption within China. Globally, wind and solar power grew strongly, accounting for almost a third of the increase in primary energy last year.

According to the 2017 BP Statistical Review, rapid growth and improving prosperity mean growth in energy demand is increasingly coming from developing economies, particularly within Asia, rather than from traditional markets in the OECD. However, the drive to improve energy efficiency is causing global energy consumption overall to decelerate. Global carbon emissions are improving, and this can be traced back to the changes in the pace and pattern of economic growth and energy consumption within China. Globally, wind and solar power grew strongly, accounting for almost a third of the increase in primary energy last year. US crude exports averaged more than 1 million barrels a day in April, driven by the significant discount of US crude prices relative to global benchmarks. New infrastructure, like the 520,000 barrels a day Dakota Access Pipeline, has reduced costs to move crude to the Gulf Coast, while major projects are underway at US Gulf Coast ports that will increase the region’s export capacity. These outward flows have served as an outlet for rising US crude production and have displaced other barrels that have struggled to then find a home.

US crude exports averaged more than 1 million barrels a day in April, driven by the significant discount of US crude prices relative to global benchmarks. New infrastructure, like the 520,000 barrels a day Dakota Access Pipeline, has reduced costs to move crude to the Gulf Coast, while major projects are underway at US Gulf Coast ports that will increase the region’s export capacity. These outward flows have served as an outlet for rising US crude production and have displaced other barrels that have struggled to then find a home. Inventory draws expected in the second and third quarters of 2017 suggest the possibility of increases in oil prices over the coming months. However, because U.S. tight oil production is relatively responsive to price changes, higher oil prices in mid-2017 have the potential to raise U.S. supply in 2018. The largest global inventory increase may occur in the second quarter of 2018, when Brazilian and OPEC production are expected to increase by 570,000 b/d and 220,000 b/d, respectively. Supply growth in 2018 could contribute to downward pressure in oil prices as early as late 2017.

Inventory draws expected in the second and third quarters of 2017 suggest the possibility of increases in oil prices over the coming months. However, because U.S. tight oil production is relatively responsive to price changes, higher oil prices in mid-2017 have the potential to raise U.S. supply in 2018. The largest global inventory increase may occur in the second quarter of 2018, when Brazilian and OPEC production are expected to increase by 570,000 b/d and 220,000 b/d, respectively. Supply growth in 2018 could contribute to downward pressure in oil prices as early as late 2017.  Pumping crude from deepwater areas is turning cheaper, and an oil price of $50 a barrel could sustain some of these projects by next year. Royal Dutch Shell has already sanctioned its Kaikias deepwater project in the Gulf of Mexico, saying it would break even with prices below $40/b, and BP has decided to move forward with its Mad Dog Phase 2 project also in the Gulf, with costs estimated at $9 billion compared to $20 billion as originally planned. Over the next three years, eight offshore projects may be approved with break-even prices below $50.

Pumping crude from deepwater areas is turning cheaper, and an oil price of $50 a barrel could sustain some of these projects by next year. Royal Dutch Shell has already sanctioned its Kaikias deepwater project in the Gulf of Mexico, saying it would break even with prices below $40/b, and BP has decided to move forward with its Mad Dog Phase 2 project also in the Gulf, with costs estimated at $9 billion compared to $20 billion as originally planned. Over the next three years, eight offshore projects may be approved with break-even prices below $50. The outlook for global independent exploration and production firms remains positive, according to Moody’s. Increased oil and natural gas production, higher commodity prices, and moderate cost increases will help independent business’ earnings grow at a healthy pace over the next 12-18 months. The global E&P sector EBITDA – Earnings Before Interest, Taxation, Depreciation and Amortization – is expected to grow by 20-30% in 2017, following declines of about 25% in 2016 and a roughly 45% drop in 2015. The sector’s oil and natural gas production will rise about 5%, and mergers and acquisitions will be robust.

The outlook for global independent exploration and production firms remains positive, according to Moody’s. Increased oil and natural gas production, higher commodity prices, and moderate cost increases will help independent business’ earnings grow at a healthy pace over the next 12-18 months. The global E&P sector EBITDA – Earnings Before Interest, Taxation, Depreciation and Amortization – is expected to grow by 20-30% in 2017, following declines of about 25% in 2016 and a roughly 45% drop in 2015. The sector’s oil and natural gas production will rise about 5%, and mergers and acquisitions will be robust. OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil.

OPEC boosted its estimates for growth in oil supplies from rival Non-OPEC producers by 64% as the U.S. oil industry’s recovery accelerates, threatening attempts by the organization and its partners to clear a surplus. Production from outside OPEC will increase by 950,000 barrels a day this year, OPEC said, revising its forecast up by about 370,000 b/d. U.S. oil and gas companies have already stepped up activities as they start to increase their spending amid a recovery in oil prices, and higher oil production is also expected in Canada and Brazil. Now is the halfway point for the 6-month oil production cuts agreed by OPEC and the 11 other oil producing countries, and the market is very close to balance. The International Energy Agency has observed that “Even at this midway point, we can consider what comes next … extending their output cuts beyond the 6-month mark would be bigger implied stock draws. This would provide further support to prices, which in turn would offer further encouragement to the US shale oil sector and other producers.”

Now is the halfway point for the 6-month oil production cuts agreed by OPEC and the 11 other oil producing countries, and the market is very close to balance. The International Energy Agency has observed that “Even at this midway point, we can consider what comes next … extending their output cuts beyond the 6-month mark would be bigger implied stock draws. This would provide further support to prices, which in turn would offer further encouragement to the US shale oil sector and other producers.” Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror.

Key points from the Lavrov-Tillerson meeting with Putin in Moscow: When Moscow and Washington cooperate, the world benefits, Both nations are focused on an uncompromising war on terror. The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War.

The interview covers various topics: Ukraine, Syria, U.S. presidential election, U.S.-Russia cooperation: “I don’t believe that we are having another Cold War.