U.S. – Russia Energy Summits To Return With Trump? lweb.es/f2611 01.16.2017

In the early 2000s, presidents Putin and Bush convened two U.S. – Russia Commercial Energy Summits. Igor Yusufov, Russia’s energy minister from 2001 to 2004 now emphasizes how the two countries could cooperate to stabilize a volatile oil market and hopes that President Donald Trump will restart the high-level meetings…

As China’s foreign exchange reserves threaten to tumble below the critical $3 trillion mark, there are fears that it will set off a vicious cycle of more outflows and currency depreciation.

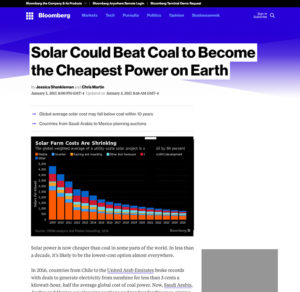

As China’s foreign exchange reserves threaten to tumble below the critical $3 trillion mark, there are fears that it will set off a vicious cycle of more outflows and currency depreciation.  Solar power is now cheaper than coal in some parts of the world. In less than a decade it could be the lowest-cost option almost everywhere.

Solar power is now cheaper than coal in some parts of the world. In less than a decade it could be the lowest-cost option almost everywhere.