Australia: Large-Scale Solar Market Set To Boom 01/08/17 •lweb.es/f2912 •bit.ly/2wr0hl9

Solar photovoltaic accounts for 11 per cent of Australia’s national electricity generation capacity and 3.3 per cent of total demand.

Solar photovoltaic accounts for 11 per cent of Australia’s national electricity generation capacity and 3.3 per cent of total demand.

“We are pursuing one of the most ambitious renewable energy development programs globally, installing 9.5 GW of wind, solar and other technologies over the next six years.

“We are pursuing one of the most ambitious renewable energy development programs globally, installing 9.5 GW of wind, solar and other technologies over the next six years. China aims to build a world-class nuclear energy innovation hub in Shanghai, planning to become a global nuclear forerunner and establishing itself as a nuclear tech leader, high-end facility manufacturer and exporter.

China aims to build a world-class nuclear energy innovation hub in Shanghai, planning to become a global nuclear forerunner and establishing itself as a nuclear tech leader, high-end facility manufacturer and exporter.  “While the Petra Nova project will certainly benefit Texas, it also demonstrates that clean coal technologies can have a meaningful and positive impact on the nation’s energy security and economic growth,” said Energy Secretary Rick Perry.

“While the Petra Nova project will certainly benefit Texas, it also demonstrates that clean coal technologies can have a meaningful and positive impact on the nation’s energy security and economic growth,” said Energy Secretary Rick Perry.  Global clean energy investment was $53.6 billion in the first quarter of 2017, down 17 per cent from the same period in 2016.

Global clean energy investment was $53.6 billion in the first quarter of 2017, down 17 per cent from the same period in 2016.  The German company E.ON is investing in the development of airborne wind energy, which offers “game-changing technologies for renewable energy production”.

The German company E.ON is investing in the development of airborne wind energy, which offers “game-changing technologies for renewable energy production”.  In the Middle East North Africa region $622 billion worth of development is planned in the energy sector for the next five years. The power sector accounts for the largest share at $207 billion, with the oil and gas sector at $195 billion and $159 billion respectively. Leading the drive will be Saudi Arabia, and Iraq and Iran will play catch-up. Algeria will pump billions into its upstream sector, and much is expected from Egypt’s recent gas. Renewable-energy projects will be at the forefront of efforts to meet rising power demand in Morocco, Tunisia and Jordan.

In the Middle East North Africa region $622 billion worth of development is planned in the energy sector for the next five years. The power sector accounts for the largest share at $207 billion, with the oil and gas sector at $195 billion and $159 billion respectively. Leading the drive will be Saudi Arabia, and Iraq and Iran will play catch-up. Algeria will pump billions into its upstream sector, and much is expected from Egypt’s recent gas. Renewable-energy projects will be at the forefront of efforts to meet rising power demand in Morocco, Tunisia and Jordan. President Trump has issued an executive order to dismantle the Obama administration’s Clean Power Plan. The “Energy Independence” order lifts a moratorium on federal coal leasing, triggers a review of methane and hydraulic fracturing restrictions, and eliminates use of the Environmental Protection Agency’s “social cost of carbon” in policymaking. From a climate action perspective, there is widespread agreement that the order is bad news for U.S. emissions. Interestingly, 62 percent of Trump voters support taxing and/or regulating pollution causing global warming, and nearly three-quarters think the U.S. should use more renewable energy in future.

President Trump has issued an executive order to dismantle the Obama administration’s Clean Power Plan. The “Energy Independence” order lifts a moratorium on federal coal leasing, triggers a review of methane and hydraulic fracturing restrictions, and eliminates use of the Environmental Protection Agency’s “social cost of carbon” in policymaking. From a climate action perspective, there is widespread agreement that the order is bad news for U.S. emissions. Interestingly, 62 percent of Trump voters support taxing and/or regulating pollution causing global warming, and nearly three-quarters think the U.S. should use more renewable energy in future. Elon Musk has promised to install and get working a Tesla Inc. battery storage system designed to prevent blackouts in South Australia, the Australian mainland state most reliant on renewable energy.

Elon Musk has promised to install and get working a Tesla Inc. battery storage system designed to prevent blackouts in South Australia, the Australian mainland state most reliant on renewable energy.  Nigeria is debating the allocation of $30 million to solar projects in this year’s budget with funding expected for off-grid solar projects, photovoltaic manufacturing, and transmission upgrades.

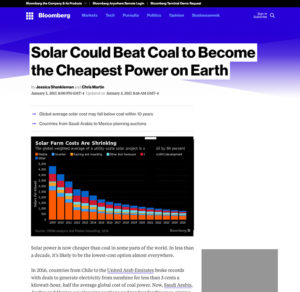

Nigeria is debating the allocation of $30 million to solar projects in this year’s budget with funding expected for off-grid solar projects, photovoltaic manufacturing, and transmission upgrades.  Solar power is now cheaper than coal in some parts of the world. In less than a decade it could be the lowest-cost option almost everywhere.

Solar power is now cheaper than coal in some parts of the world. In less than a decade it could be the lowest-cost option almost everywhere.