By Stuart Wilkinson, OEF.

A couple of decades ago Petróleos de Venezuela, PDVSA, had plans to use part of the crude oil in the Orinoco Oil Belt as a feedstock for electricity generation. Thus “Orimulsion” came into being. Operations, however, were closed down in 2005 but there is little doubt that its use as a boiler fuel was proved internationally in spite of its emissions. Most importantly perhaps, the use of Orimulsion could have contributed to Venezuela’s industrial development, and still could do so if the green light were given.

A couple of decades ago there were plans to use part of the crude oil in the Orinoco Oil Belt as a feedstock for electricity generation. Thus “Orimulsion” came into being. Here, crude oil was mixed with water and an emulsifier added so that the oil and the water would not separate. Orimulsion would compete with coal. Even though commercial supply contracts had been signed in various countries, Orimulsion operations were closed down in 2005. The reasons behind the decision was at the time reported to be based on economics: the corporation had decided that it could make larger profits by selling fuel oil than Orimulsion; it was competing with fuel oil in power stations and so there would be an impact on the world oil price; and additionally the rush into the Orinoco Belt was about to generate a major contradiction in Venezuelan oil policy since it was not compatible with revenue and price objectives. (1)

Now that the “Shale Revolution” has reduced the opportunities in the U.S. market for international petroleum producers, a pertinent question would be the following: Should Venezuela re-balance its plans for the development of its petroleum industry by reviving Orimulsion? The country would thus be producing a boiler fuel for use in thermoelectric power plants to produce electricity for the country’s national grid.

Emissions problems

However, and this point must be made clear, Orimulsion came up against environmental questions: in 1997 two British power stations, Pembroke and Richborough, failed to renew their contracts for Orimulsion; at the same time a Florida state regulating committee decided to reject a deal with Florida Power and Light to use Orimulsion in its Manatee power plant. Both the cancellation of the British contracts and the decision by the Florida were ultimately prompted by environmental concerns raised by the use of Orimulsion.” (2)

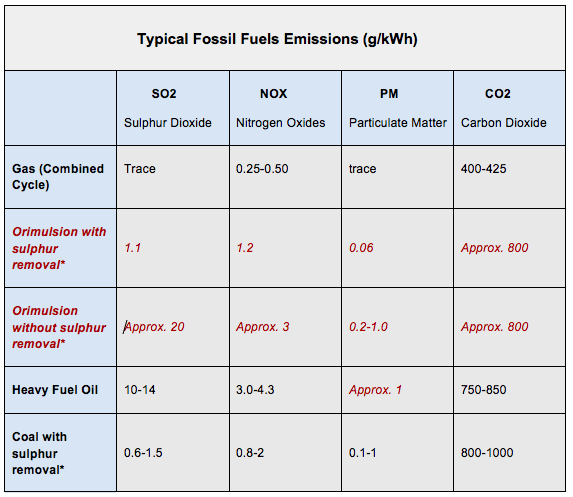

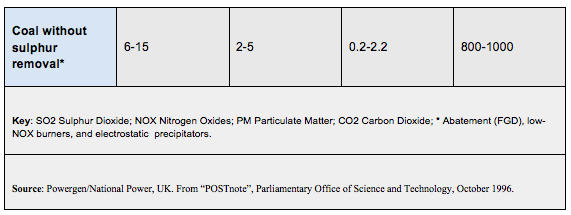

Just previously, in October 1996, the UK Parliamentary Office of Science and Technology published the following detailed table with regard to emissions from coal, heavy fuel oil, gas, and Orimulsion. Since at that time, “fuels derived from bitumen e.g. Orimulsion” (3) were under consideration for expanded use in UK power stations, in particular in National Power’s mothballed station near Pembroke in Wales. The Parliamentary Office also noted that concerns had been raised in Parliament and elsewhere over the potential air pollution from such fuels, and the potential environmental effects of any Orimulsion spill.

The following table compares Orimulsion emissions with coal, heavy fuel oil, and gas. Here, Orimulsion ranks a little cleaner than coal but much cleaner than heavy fuel oil. Gas is the cleanest by far:

Vanadium and nickel can be recovered and commercialized

During the same period, and with regard to toxic emissions, the report “The Recovery and Recycling of Vanadium and Nickel from the Combustion Residues of Orimulsion and Other Fuels”, which was a project funded by the European Community under the BRITE/EURAM II Programme, May 1996, indicated that the vanadium and nickel present in the ash after burning Orimulsion could be recovered and commercialized:

“When Orimulsion is combusted a very fine ash is produced, much of which is carried up the power station flue stack with the flue gases .… The fine dust or fly ash contains significant amounts of vanadium and nickel, which derive from the Orimulsion fuel oil. Nickel is a carcinogen and vanadium species classed as toxic substances … and … represent an environmental hazard, unless dealt with in a responsible manner. Hydrometallurgical techniques provide a more cost effective method of recovering vanadium from vanadium rich fly-ashes, consequently Orimulsion as a new source of vanadium is reported in this short paper … [and] … nickel … is also a valuable material in economic terms. In terms of its metal price this has varied over the three years of the project from $2.4 per pound to $4 per pound. This is in contrast to the vanadium price which has varied from a low of $1.2 per pound up to a high of $4.3 per pound.” (4)

The Parliamentary Office’s newsletter “POSTnote” gave Orimulsion’s cost to be around £33 per tonne at that time – it was priced to compete with coal – so the recovery and commercialization of vanadium and nickel from power station flue ash should therefore be taken within this price context. In addition, further economic benefits could accrue from the by-products of the flue-gas desulphurisation (FGD) process that the Pembroke power station would use: an input of 600,000 tonnes of limestone per year would be required, but this would generate about one million tonnes per year of gypsum, which could be sold for wallboard manufacture, road construction, soil improvement, and cement manufacture, for example. This form of gypsum, known as “FGD gypsum” cost $35 to $50 per tonne in early 2014. (5) One would expect, therefore, that such recovery and commercialization would offset some costs arising from burning Orimulsion.

Can be used in diesel engines

According to the 2004 study “Orimulsion is the best way to monetize the Orinoco bitumen”, Orimulsion can be used in diesel engines for power generation, in cement plants, as a feedstock for Integrated Gasification Combined Cycle and as a “reburning” fuel (a method of reducing NOx by staging combustion in the boiler).

The article adds that in 2001 Orimulsion was included in the Venezuelan Electricity Plan. The fuel would supply an important part of the forecasted increase in the demand for electricity at low cost. This plan contemplated not only the conversion to Orimulsion of existing oil and gas-fired plants but also the construction of new capacity specially designed for Orimulsion. A large electricity generating complex in the Orinoco Belt, just on top of the bitumen reservoir, the study adds, would bring an appreciable and structural reduction in generating costs since the Orimulsion would be manufactured “just in time” next to the point of use. (6)

This being said, during the period of its life there had been positive reactions to Orimulsion as a boiler fuel in the international arena; but there had also been negative reactions, specifically with respect to its cleanliness as has been noted above.

Global commercialization…

Here follows a brief outline of the commercialization and use of Orimulsion in various countries. (7) Trading activities were performed through Bitor as well as through Bitor America Corporation, Florida; Bitor Europe, London; and MC Bitor, Tokyo. As a matter of interest, exports in 1994 were two million five hundred thousand tons, 28% up over 1993.

Latin America

In Latin America, advances were made in the negotiations for supplying Orimulsion to the Central Electrica San Nicolás in Buenos Aires, Argentina;

Brazil was prepared to offer a preferential customs tariff for Orimulsion; Chile was interested in a supply contract for a 120 MW plant in Calderas, in the north-central part of the country, where plans were to use Orimulsion in diesel engines.

North America

Bitor America made the first shipment of Orimulsion to the New Brunswick Power Corporation (NBP) of Canada under the long-term contract signed in 1990 to supply up to 800,000 tons per annum; the conversion of NBP’s 310 MW plant in Dalhousie to Orimulsion was completed with burning starting in September; a 20-year contract with Florida Power and Light (FPL) was signed to supply the 1580 MW Manatee plant – annual requirements would be 4,000,000 tons, and a contract was signed with Pure Air (a partnership of Air Products and Chemicals and Mitsubishi Heavy Industries) for the construction and operation of a flue gas desulphurization plant for the two 790 MW plant units at Manatee.

Europe

The European affiliate of Bitor, the London-based Bitor Energy PLC (BEC), had been promoting, with Bitor, the participation of European companies in generation, flue gas cleaning, and ash recycling projects. Significant progress was made in optimizing the technology for recovering vanadium, nickel, and magnesium from Orimulsion ashes. BEC had also been working closely together in this with REAKT (British) and STRATCOR (North American) to set up a joint venture to process between 6,000 tons and 10,000 tons of Orimulsion ashes per annum.

During 1994, 1,450,000 tons of Orimulsion were delivered to Europe, and sales of 2,800,000 tons were secured for 1995. Two industrial trials in cement kilns in Italy and Germany were successfully completed: one at the UNICEM Cadola cement plant, consuming 250 tons of Orimulsion, and the other at Phoenix’s Beckum cement plant consuming 840 tons. Both trials confirmed that Orimulsion could be used as an alternative fuel for producing cement

clinker.

Two single burner trials were completed during the year: one to evaluate the performance of the low NOx burners installed in the SK Power Asnaes 700 MW unit near Kalundborg, Denmark, and the other in the NEFO 300 MW plant of Elsam. Near year-end Bitor Europe (BEL) signed a contract with SK Power for the Asnaes 700 MW unit – this was in a country where very strict environmental legislation is applicable. A full boiler trial was initiated at CPPE’s Setubal Unit 4, Portugal, for which approximately 93,000 tons of Orimulsion were delivered in accordance with the permanent supply agreement. Also during 1994, feasibility studies were completed for five sites and support was given to National Power, UK, for the bid specification for the conversion of the 2000 MW Pembroke plant and in the preparation of the corresponding environmental impact study.

Asia

A contract was signed with China North Industries Corporation for the marketing and supply of 1,200,000 tons of Orimulsion; a Letter of Agreement was signed with the Ssangyong Corporation, Korea, for the promotion of Orimulsion in that country; and India was also interested in quantifying the domestic market potential of Orimulsion.

In Thailand, Orimulsion was accepted as a base fuel together with natural gas and coal by that country’s Electricity Generating Authority.

With regard to Japan, MC Bitor, an equal share partnership between Bitor and Mitsubishi Corporation, exported to its Japanese customers Kashima Kita Electric Power Corporation, Mitsubishi Kasei Corporation and Kansai Electricity Power Company approximately 700,000 tons of Orimulsion. Kashima Kita consumed approximately 355,000 tons in 1994, Mitsubishi Kasei 215,000 tons, and Kansai 120,000 tons. Notably, (8) Kashima Kita was the first company to use Orimulsion in Japan and said that it converted its plant to use the Venezuelan fuel in 1991, so far showing optimum performance. Moreover, in the light of these results, the company decided to build another Orimulsion-fuelled plant, planned to become Japan’s largest power facility with capacity to generate 4,400 megawatts. Also, Hokkaido Electric Power Company began construction of a new 350 MW capacity plant planned to consume approximately 200,000 tons of Orimulsion per annum, to be burned alternately with heavy fuel oil starting in 1996.

In the Philippines, the state owned National Power Corporation evaluated the usage of Orimulsion as a base fuel in plants whose consolidated power generating capacity was approximately 1,700 MW.

In Malaysia, the state owned Tenaga Nasional Berhad utility undertook feasibility studies for the use of Orimulsion in its power plants of approximately 900 MW, either new ones or those under consideration for conversion.

In addition, PowerSeraya, Singapore, said that its alternative fuel, Orimulsion, put it in a position to withstand pricing and supply shocks, which would become more important as the prices of traditional fossil fuels remained high and volatile: “Fuel is about 70 per cent of our cost structure, so having alternatives helps us mitigate the risk of fuel supply disruption,” said the company, “It also helps us move away from reliance on natural gas and conventional oil.” PowerSeraya upgraded its three units of 250MW steam plants and invested more than $100 million in emission control equipment to reduce the emissions of pollutants, such as sulphur dioxide and particulate matter, by 95 per cent by 97 per cent respectively. The company added that the Orimulsion generation unit helped reduces overall emissions in the power-generation operation by half. The company hoped to have three units of 250MW steam plants operated by Orimulsion, adding to its current capacity of six units of 250MW steam plants that ran on conventional fuel oil and two units of 370MW combined cycle plants that ran on natural gas. “Orimulsion as an alternative can produce electricity at the same price as the current cheapest way,” added the company. (9)

After this brief historical outline, it seems clear that Orimulsion was by no means a failure within the context of power generation in various parts of the world, even with its environmental problems that led to doors being closed in both the United Kingdom and North America.

So one may perhaps now consider the following question: Would it be a viable option to revive Orimulsion – not principally for export… but for the additional power generation that will most surely be required once Venezuela takes the path of growth once more?

References:

- “Venezuelan oil politics at the crossroads”, Bernard Mommer, Oxford Institute for Energy Studies, March 2001.

- “Orimulsion fighting setbacks”, Enfoque Petrolero, October 1997

- Powergen/National Power, UK. From “POSTnote”, Parliamentary Office of Science and Technology, October 1996.

- “The Recovery and Recycling of Vanadium and Nickel from the Combustion Residues of Orimulsion and Other Fuels”, a project funded by the European Community under the BRITE/EURAM II Programme, May 1996.

- “Gypsum for Field Application”. Paulding County Progress, 2nd March 2014.

- “Orimulsion is the best way to monetize the Orinoco bitumen”. Carlos Rodriguez, Sept-Oct 2004.

- Bitor 1994 Annual report, PDVSA Contact No.43, Rippet Jan-Feb. 1992.

- “Orimulsion fighting setbacks”, Enfoque Petrolero, October 1997.

- Business Times, 12th April 2005.