OEF Rapid Review Articles

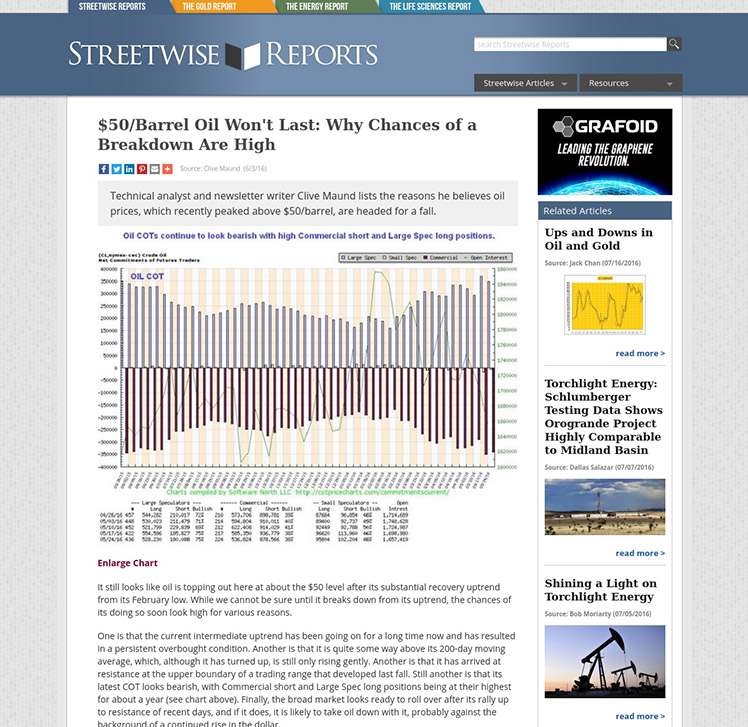

Technical analyst Clive P. Maund lists the reasons he believes oil prices, which recently peaked above $50 a barrel, are headed for a fall: “It still looks like oil is topping out here at about the $50 level after its substantial recovery uptrend from its February low. While we cannot be sure until it breaks down from its uptrend, the chances of its doing so soon look high for various reasons.”

LINK TO THE SOURCE ARTICLE:

https://www.streetwisereports.com/pub/na/16997

LINK TO THE SOURCE ARTICLE:

https://www.streetwisereports.com/pub/na/16997