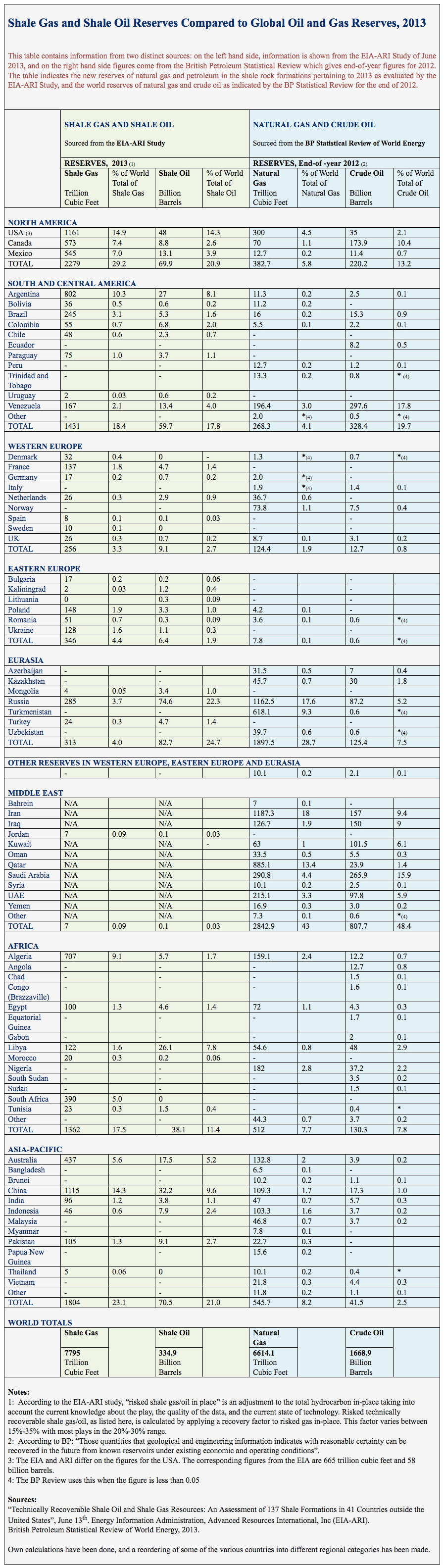

The following table is a combination of the information provided by the study “An Assessment of 137 Shale Formations in 41 Countries outside the United States”, June 2013, produced by the Energy Information Administration and Advanced Resources International, Inc (EIA-ARI), and the “British Petroleum Statistical Review of World Energy, 2013”. In order to make the information from the two sources as clear and compatible as possible, various changes have been made to the categorization of some countries with regard to the naming of their region. Furthermore, the percentages that are given in the shale oil and shale gas columns are personal calculations referring to the EIA-ARI study. In contrast, BP has made its own percentage calculations.

It must be clearly noted that the EIA-ARI report makes it clear that “Significant additional shale gas and shale oil resources exist in the Middle East, Central Africa and other countries not yet included in our study…”

One may appreciate, therefore, that the information that follows does not yet tell the whole story.

Some observations on the table, however, are quite revealing:

- U.S. shale gas “reserves”, in other words “technically recoverable shale oil and shale gas resources” are nearly four times U.S. natural gas reserves.

- U.S. shale oil reserves are one third more than U.S. crude oil reserves.

- U.S. shale gas and shale oil reserves represent 14.9% and 14.3% respectively of world totals.

- Mexico’s shale gas reserves are 43 times its natural gas reserves.

- Argentina’s shale gas reserves are 71 times its natural gas reserves; and its shale oil reserves are nearly eleven times its crude oil reserves.

- Brazil’s shale gas reserves are 15 times its natural gas reserves.

- Paraguay, with no natural gas reserves, has 75 trillion cubic feet of shale gas reserves.

- Venezuela has 15% less shale gas reserves than natural gas reserves; and shale oil reserves represent 4.5% of crude oil reserves.

- France, with no natural gas reserves, has 137 trillion cubic feet of shale gas reserves.

- Poland’s shale gas reserves represents 35 times those of its natural gas reserves.

- Ukraine, with no natural gas reserves, has 128 trillion cubic feet of shale gas reserves.

- Russia’s shale gas reserves represent nearly 25% of its natural gas reserves; and its shale oil “reserves” are 14% less than its crude oil reserves.

- Turkey has 24 trillion cubic feet of shale gas reserves and 4.7 billion barrels of shale oil reserves, compared to no natural gas and crude oil reserves.

- Algeria has four and a half times more reserves of shale gas than natural gas, and shale oil reserves are 47% of crude oil reserves.

- South Africa has 390 trillion cubic feet of shale gas reserves compared to no natural gas reserves.

- Australia’s reserves of shale gas are 3.3 times that of its natural gas reserves, and its shale oil reserves are four and a half times those of its crude oil reserves.

- China’s shale gas reserves are ten times those of its natural gas reserves, and its shale oil reserves are nearly twice those of its crude oil reserves.

- Pakistan’s shale gas reserves are four and a half times its natural gas reserves; and the country, with no crude oil reserves, has 9 billion barrels of shale oil reserves.

- World reserves of shale gas are 18% more than world natural gas reserves, and world shale oil reserves are 20% of crude oil reserves.

- World gas reserves are twice the size that they used to be.

By Stuart Wilkinson

oileconomyfocus.com

___________________

Shale Oil: Will the “Shale Revolution” be just in the United States?